Microsoft Dynamics 365 Fraud Protection

A next-generation hybrid fraud management solution is developed to increase fraud detection accuracy and improve operational effectiveness. The solution is fully integrated into our digital commerce platform: a single integration and onboarding for our payment services and Microsoft’s Fraud Protection. There is no limitation on geography or business verticals.

Features

- AI-powered tool: core technology is adaptive AI, trained by the fraud protection network, which empowers machine learning and provides a broad awareness of fraud activity across the globe and within business verticals

- Mixed fraud screening models: suit your business needs by choosing traditional static rules, machine learning, or a hybrid combination of both

- Multi-hierarchy: manage your fraud strategy at any level (set up rules per branch, country, MID, etc.)

- Payment methods variety: choose from all presented card products, direct debit, and alternative payment methods supported by us

- Device fingerprinting: benefit from a fully integrated device intelligence at no additional cost

- Custom data flexibility: send any extra data fields in the desired format to create fraud rules and enhance their performance

What does it mean for you?

- Pre-authorization monitoring: filter potential risks before the transactions are sent to the bank and increase authorization rates

- Outstanding dataset: combine Worldline, Microsoft’s Fraud Protection network, industry leaders, and your transactional data to build up your own machine-learning fraud tool

- Risk appetite calibration: find the optimum balance between approving orders and detecting fraud activity

- Virtual fraud analyst reporting: analyze and monitor your controls

Available tools

View the transaction details

A comprehensive transactional summary is easily accessible, neatly organized into predefined sections for your convenience.

Virtual fraud analyst

You can analyze patterns and gain profound insights into your fraud management controls.

Risk score

This score uses AI to estimate the chance of a transaction being fraudulent. The platform relies on data from the fraud protection network to identify events and detect fraud connections. By carefully examining each transaction within Microsoft Dynamics 365, you can use these identified links to efficiently tackle emerging fraud risks and protect your business.

The risk score is an integer between 0 and 999 (inclusive). The higher the score, the higher the likelihood that the transaction is fraudulent.

Lists

You're free to create Standard, Block, Watch and Safe lists using the built-in functionality to simply add any of these 5 attributes to your list:

- User ID

- Device ID

- IP address

- Payment ID

- Email address

Custom lists are created and defined by you to implement specific business policies to manage your fraud protection strategy. You can reference your lists in rules dynamically.

Rules

You can create rules with the properties you send in the payment request, use the risk score generated by the AI model, or employ both methods. The output will be a decision that determines the next transaction step.

The rate at which certain actions occur, whether attributed to a user or entity (like a credit card), can be a signal of suspicious behavior and possible fraudulent activity. For example, when fraudsters attempt a series of separate orders, they frequently use one or more credit cards to swiftly perform multiple orders from a single IP address or device. This pattern often points to potential fraudulent actions.

You can also set up velocity checks to monitor unusual patterns and how often suspicious events occur. There's an option to define thresholds in your rules to control and mitigate potential risks effectively.

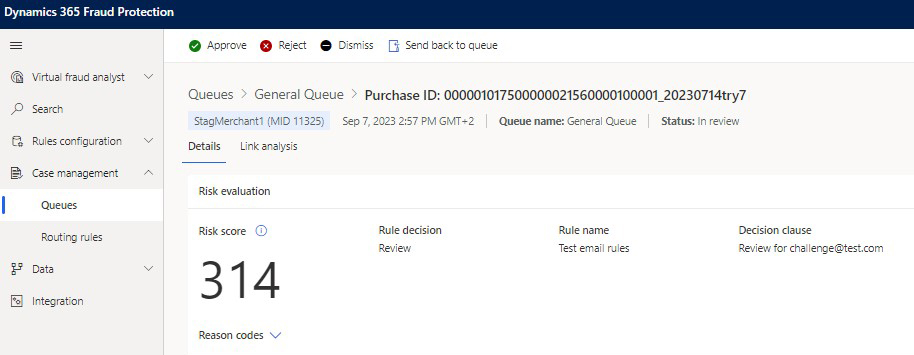

Case management

When you configure the rules to activate a Challenge decision, it initiates the creation of a case in your designated queue that the fraud expert within your organization will review. You can also categorize these cases into distinct queues for your fraud team to assess manually. To perform a transaction review:

- Go to Case Management and select View Cases from the specific queue you need to review. Inspect the transaction details.

- Inspect the transaction details.

- On the Link Analysis tab, you can examine additional transactions related to the case you're reviewing. Choose specific attributes to display transactions that share the same attributes. This feature helps to trace and understand the links between transactions.

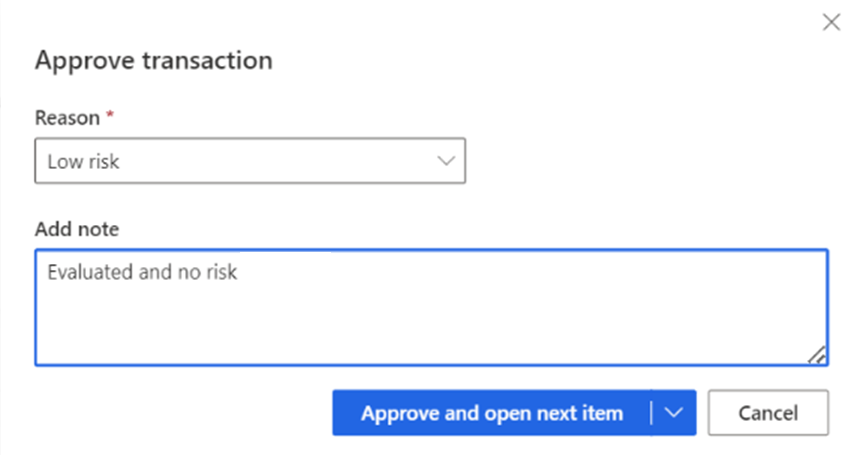

- Using this data, decide to Approve or Reject the transaction, specifying the reason (it's also possible to include notes).

Data fields

When you send a payment request, there are various fields included that need to be filled out. We encourage you to send as many fields as possible, as not all of them are mandatory. Sending more data in your request also helps the machine learning models to get educated in real time by consuming and assessing the data signals for more effective fraud detection. For a detailed description of data fields, refer to our API reference.

Some of the objects down below are conditional, such as:

- shipping - only applicable if you ship physical goods.

- fraudfields - custom fields for data that is specific to your business (you may find it beneficial to use it for your fraud rules).

- mandate.customer.companyName - only available for paymentProductId 771 (SEPA Direct Debit).

- mandate.customer.bankAccountIban.iban - only available for paymentProductId 771 and 770.

Use the tables below to see which fields you need to send in your request.

| Mandatory | If you do not send these fields in your request, the fraud screening cannot be processed. | |

| Highly recommended | Useful data that will help you detect fraud. You should strongly consider sending these fields in your request to enhance your fraud detection. | |

| Industry-specific (airline) | Essential data if you are operating in a specific industry. | |

| Industry-specific (hospitality) | Essential points if you are operating in a specific industry. | |

| Industry-specific (retail) | Essential data if you are operating in a specific industry. | |

| Conditional | Required data to use depending on the specific object. If you don't include it, the entire object will not be sent for fraud screening, affecting your overall fraud detection results. | |

| Additional | Optional data that can improve your fraud detection. |

| Property | Type | Suggestion | Details |

|---|---|---|---|

| order | object | Order object containing order-related data. Please note that this object is required to be able to submit the amount. | |

| amountOfMoney | object | Object containing amount and ISO currency code attributes. | |

| currencyCode | string(3) | Three-letter ISO currency code representing the currency for the amount. | |

| amount | integer(12) | Amount in cents and always having 2 decimals. | |

| references | object | Object that holds all reference properties that are linked to this transaction. | |

| merchantReference | string | Your unique reference of the transaction that is also returned in our report files. This is almost always used for your reconciliation of our report files. Note:

|

|

| additionalInput.airlineDate | object | ||

| agentNumericCode | string(8) | Numeric code identifying the agent. | |

| code | string(3) | Airline numeric code. | |

| flightDate | string(8) | Date of the flight. Format: YYYYMMDD | |

| flightLegs.items | object | ||

| airlineClass | string | Reservation Booking Designator. | |

| carrierCode | string(2) | IATA carrier code. | |

| date | string(8) | Date of the leg. YYYYMMDD |

|

| arrivalAirport | string(3) | Arrival airport/city code. | |

| fare | string(12) | Fare of this leg. | |

| fareBasis | string(15) | Fare Basis/Ticket Designator | |

| departureTime | string(6) | The departure time in the local time at the departure airport. Format: HH:MM |

|

| flightNumber | string(4) | The flight number assigned by the airline carrier with no leading spaces. Should be a numeric string. | |

| originAirport | string(3) | Origin airport/city code. | |

| number | integer(5) | Sequence number of the flight leg. | |

| stopoverCode | string | Possible values are:

|

|

| invoiceNumber | string(6) | Airline tracing number. | |

| merchantCustomerId | string(16) | Your ID of the customer in the context of the airline data. | |

| isETicket | boolean |

|

|

| issueDate | string(8) | This is the date of issue recorded in the airline system In a case of multiple issuances of the same ticket to a cardholder, you should use the last ticket date. Format: YYYYMMDD |

|

| pnr | string(217) | Passenger name record. | |

| ticketDeliveryMethod | string | Possible values:

|

|

| passengerName | string(49) | Name of the passenger. | |

| ticketNumber | string(13) | The ticket or document number. On the Ogone Payment Platform and the GlobalCollect Payment Platform it contains:

|

|

| placeOfIssue | string(15) | Place of issue. For sales in the US the last two characters (POS 14-15) must be the US state code. |

|

| pointOfSale | string(25) | IATA point of sale name. | |

| posCityCode | string(10) | City code of the point of sale. | |

| isRestrictedTicket | boolean |

|

|

| isThirdParty | boolean |

|

|

| name | string(20) | Name of the airline. | |

| additionalInput.lodgingData | object | Object that holds lodging specific data. | |

| charges.items | array of objects | Object that holds lodging related charges. | |

| chargeAmount | integer(12) | Amount of additional charges associated with the stay of the guest. Note: The currencyCode is presumed to be identical to the order.amountOfMoney.currencyCode. |

|

| chargeAmountCurrencyCode | string(3) | Currency for charge amount. The code should be in 3 letter ISO format. | |

| chargeType | string | Type of additional charges associated with the stay of the guest. Allowed values:

|

|

| folioNumber | string(25) | The Lodging Folio Number assigned to the itemized statement of charges and credits associated with this lodging stay, which can be any combination of characters and numerals defined by the Merchant or authorized Third Party Processor. | |

| checkInDate | string(8) | The date the guest checks into (or plans to check in to) the facility. Format: YYYYMMDD |

|

| checkOutDate | string(8) | The date the guest checks out of (or plans to check out of) the facility. Format: YYYYMMDD |

|

| isConfirmedReservation | boolean | Indicates whether the room reservation is confirmed.

|

|

| numberOfAdults | integer(3) | The total number of adult guests staying (or planning to stay) at the facility (i.e., all booked rooms). | |

| numberOfNights | integer(4) | The number of nights for the lodging stay. | |

| numberOfRooms | integer(4) | The number of rooms rented for the lodging stay. | |

| propertyPhoneNumber | string(20) | The local phone number of the facility in an international phone number format. | |

| propertyCustomerServicePhoneNumber | string(20) | The international customer service phone number of the facility. | |

| rooms.items | array of objects | Object that holds lodging-related room data. | |

| typeOfRoom | string(12) | Describes the type of room, e.g., standard, deluxe, suite. | |

| typeOfBed | string(12) | Size of bed, e.g., king, queen, double. | |

| dailyRoomRate | string(12) | Daily room rate exclusive of any taxes and fees. Note: The currencyCode is presumed to be identical to the order.amountOfMoney.currencyCode. |

|

| dailyRoomRateCurrencyCode | string(3) | Currency for daily room rate. The code should be in 3 letter ISO format. | |

| dailyRoomTaxAmount | string(12) | Daily room tax. Note: The currencyCode is presumed to be identical to the order.amountOfMoney.currencyCode. |

|

| customer | object |

Object containing the details of the customer. Depends on: required, except when a token has been included in the request that includes at least the countryCode in the billingAddress. |

|

| merchantCustomerId | string(15) | Your identifier for the customer. It can be used as a search criteria in the GlobalCollect Payment Console and is also included in the GlobalCollect report files. It is used in the fraud-screening process for payments on the Ogone Payment Platform. Depends on:

|

|

| isPreviousCustomer | boolean | Specifies if the customer has a history of online shopping with the merchant.

|

|

| contactDetails | object | Object containing contact details like email address and phone number. | |

| emailAddress | string(70) | Email address of the customer. The '+' character is not allowed in this property for transactions that are processed by TechProcess Payment Platform. | |

| phoneNumber | string(20) | Phone number of the customer. The '+' character is not allowed in this property for transactions that are processed by TechProcess Payment Platform. | |

| personalInformation | object | Object containing personal information like name, date of birth and gender. | |

| name | object | Object containing the name details of the customer. | |

| firstName | string(15) | Given name(s) or first name(s) of the customer. The '+' character is not allowed in this property for transactions that are processed by TechProcess Payment Platform. | |

| surname | string(70) | Surname(s) or last name(s) of the customer. The surname is truncated after 25 characters, with the limit being applied after surnamePrefix is prepended, for payments, refunds or payouts that are processed by the WL Online Payment Acceptance platform The '+' character is not allowed in this property for transactions that are processed by TechProcess Payment Platform. | |

| locale | string(6) |

The locale that the customer should be addressed in (for 3rd parties). Note that some 3rd party providers only support the languageCode part of the locale, in those cases we will only use part of the locale provided. |

|

| billingAddress | object | Object containing billing address details. | |

| street | string(50) | Street name. | |

| houseNumber | string(15) | House number. The houseNumber is truncated after 10 characters for payments, refunds or payouts that are processed by the WL Online Payment Acceptance platform. | |

| additionalInfo | string(50) | Additional address information. The additionalInfo is truncated after 10 characters for payments, refunds or payouts that are processed by the WL Online Payment Acceptance platform. | |

| zip | string | Zip code. Note: For payments with product 1503 the maximum length is not 10 but 8. |

|

| city | string | City. Note: For payments with product 1503 the maximum length is not 40 but 20. |

|

| state | string(50) | Full name of the state or province. | |

| countryCode | string(2) | ISO 3166-1 alpha-2 country code. | |

| device | object | Object containing information on the device and browser of the customer. | |

| deviceFingerprintTransactionId | string | One must set the deviceFingerprintTransactionId received by the response of the endpoint /{merchant}/products/{paymentProductId}/ deviceFingerprint |

|

| ipAddress | string(45) | The IP address of the customer client from the HTTP Headers. | |

| timezoneOffsetUtcMinutes | string(6) | Offset in minutes of timezone of the client versus the UTC. Value is returned by the JavaScript getTimezoneOffset() API call. If you use the latest version of our JavaScript Client SDK, we will collect this data and include it in the encryptedCustomerInput property. We will then automatically populate this data if available. |

|

| defaultFormFill | string | Degree of default form fill, with the following possible values:

|

|

| account | object | Object containing data related to the account the customer has with you. | |

| paymentAccountOnFile | object | Object containing information on the payment account data on file (tokens). | |

| createDate | string(8) | The date (YYYYMMDD) on which the customer created their account with you. | |

| numberOfCardOnFileCreationAttemptsLast24Hours | integer(3) | Number of attempts made to add new card to the customer account in the last 24 hours. | |

| hadSuspiciousActivity | boolean | Specifies if you have experienced suspicious activity on the account of the customer.

|

|

| authentication | object | Object containing data on the authentication used by the customer to access their account. | |

| method | string |

Authentication used by the customer on your website or app

|

|

| shipping | object | Object containing information regarding shipping / delivery. | |

| type | string | Indicates the merchandise delivery timeframe. Possible values:

|

|

| emailAddress | string(70) | Email address linked to the shipping. | |

| trackingNumber | string(19) | Shipment tracking number. | |

| comments | string(160) | Comments included during shipping. | |

| address | object | Object containing address information. | |

| additionalInfo | string(50) | Additional address information. | |

| name | object | Object that holds name elements. | |

| firstName | string(15) | Given name(s) or first name(s) of the customer. The '+' character is not allowed in this property for transactions that are processed by TechProcess Payment Platform. | |

| surname | string(70) | Surname(s) or last name(s) of the customer. The surname is truncated after 25 characters, with the limit being applied after surnamePrefix is prepended, for payments, refunds or payouts that are processed by the WL Online Payment Acceptance platform The '+' character is not allowed in this property for transactions that are processed by TechProcess Payment Platform. | |

| surnamePrefix | string(15) | Middle name - in between first name and surname - of the customer. The '+' character is not allowed in this property for transactions that are processed by TechProcess Payment Platform. | |

| title | string(35) | Title of customer. | |

| street | string(50) | Street name. | |

| houseNumber | string(15) | House number. | |

| zip | string | Zip code. | |

| countryCode | string(2) | ISO 3166-1 alpha-2 country code. | |

| shoppingCart.items | array of objects | Shopping cart data. | |

| amountOfMoney | object | Object containing amount and ISO currency code attributes. Note: make sure you submit the amount and currency code for each line item. |

|

| currencyCode | string(3) | Three-letter ISO currency code representing the currency for the amount. | |

| amount | integer(12) | Amount in cents and always having 2 decimals. | |

| invoiceData | object | Object containing the line items of the invoice or shopping cart. The '+' character is not allowed in this property for transactions that are processed by TechProcess Payment Platform. | |

| description | string(116) | Shopping cart item description. | |

| orderLineDetails | object | Object containing additional information that when supplied can have a beneficial effect on the discount rates. | |

| productCode | string(12) | Product or UPC Code, left justified. Note: Must not be all spaces or all zeros |

|

| productType | string(12) | Code used to classify items that are purchased. Note: Must not be all spaces or all zeros |

|

| productName | string(120) | The name of the product. The '+' character is not allowed in this property for transactions that are processed by TechProcess Payment Platform. | |

| productCategory | string(50) | The category of the product (i.e. home appliance). This property can be used for fraud screening on the Ogone Platform. | |

| productPrice | string(12) | The price of one unit of the product, the value should be zero or greater. | |

| quantity | integer(4) | Quantity of the units being purchased, should be greater than zero. Note: Must not be all spaces or all zeros | |

| cardPaymentMethodSpecificInput | object | Object containing the specific input details for card payments. | |

| paymentProductId | integer(5) | Payment product identifier. Please see payment products for a full overview of possible values. |

|

| card | object | ||

| cvv | string(4) | Card Verification Value, a 3 or 4 digit code as an additional security feature for card not present transactions. | |

| cardNumber | string(19) | The complete credit/debit card number (also know as the PAN). The minimum input length is 12 digits. The card number is always obfuscated in any of our responses. |

|

| expiryDate | string(4) | Expiry date of the card. Format: MMYY |

|

| skipFraudService | boolean |

|

|

| isRecurring | boolean |

|

|

| recurring | object | Object containing data related to recurring. | |

| minFrequency | integer(4) | Minimum number of days between authorizations. If no value is provided we will set a default value of 30 days. | |

| endDate | string(8) | The date that the trial period ends in YYYYMMDD format. | |

| recurringPaymentSequenceIndicator | string |

Note: Will default to first when isRecurring is set to true, with the following exception that it is set to recurring when the customer is making the payment using a PayPal token.

|

|

| threeDSecure | object | Object containing specific data regarding 3-D Secure. | |

| skipAuthentication | boolean |

|

|

| redirectionData | object | Object containing browser specific redirection related data. | |

| returnUrl | string(512) | The URL that the customer is redirect to after the payment flow has finished. You can add any number of key value pairs in the query string that, for instance help you to identify the customer when they return to your site. Please note that we will also append some additional key value pairs that will also help you with this identification process. Note: The provided URL should be absolute and contain the protocol to use, e.g. http:// or https://. For use on mobile devices a custom protocol can be used in the form of protocol://. This protocol must be registered on the device first. URLs without a protocol will be rejected. |

|

| directDebitPaymentMethodSpecificInput | object | Object containing the specific input details for direct debit payments. | |

| paymentProductId | integer(5) | Payment product identifier. Please see payment products for a full overview of possible values. |

|

| paymentProduct730SpecificInput | object | Object containing ACH specific details. | |

| bankAccountBban | object | Object containing account holder name and bank account information. | |

| accountNumber | string | Bank account number. | |

| bankCode | string | Bank code. | |

| branchCode | string | Branch code. | |

| bankName | string(40) | Name of the bank. | |

| countryCode | string(2) | ISO 3166-1 alpha-2 country code of the country where the bank account is held For UK payouts this value is automatically set to GB as only payouts to UK accounts are supported. | |

| accountHolderName | string(30) | Name of the account holder. | |

| paymentProduct705SpecificInput | object | Object containing UK Direct Debit specific details. | |

| bankAccountBban | object | Object containing account holder name and bank account information. | |

| accountNumber | string | Bank account number. | |

| bankCode | string | Bank code. | |

| branchCode | string | Branch code. | |

| bankName | string(40) | Name of the bank. | |

| countryCode | string(2) | ISO 3166-1 alpha-2 country code of the country where the bank account is held For UK payouts this value is automatically set to GB as only payouts to UK accounts are supported. | |

| accountHolderName | string(30) | Name of the account holder. | |

| sepaDirectDebitPaymentMethodSpecificInput | object | Object containing the specific input details for SEPA direct debit payments. | |

| paymentProductId | integer(5) | Payment product identifier. Please see payment products for a full overview of possible values. |

|

| token | string(40) | ID of the token that holds previously stored card data. If both the token and card are provided, then the card takes precedence over the token. | |

| merchant | object | Object containing information on you, the merchant. | |

| contactWebsiteUrl | string(2048) | URL to find contact or support details to contact in case of questions. | |

| fraudFields | object | Object containing additional data that will be used to assess the risk of fraud. | |

| customerIpAddress | string(45) | The IP Address of the customer that is making the payment. The '+' character is not allowed in this property for transactions that are processed by TechProcess Payment Platform. | |

| orderTimezone | string(2) | Timezone in which the order was placed. The '+' character is not allowed in this property for transactions that are processed by TechProcess Payment Platform. | |

| giftCardType | string | One of the following gift card types:

|

|

| giftMessage | string(160) | Gift message | |

| userData | array | Array of up to 16 userData properties, each with a max length of 256 characters, that can be used for fraud screening. |