Fraud prevention services

In the world of digital payments, the threat of facing untrustworthy transactions is inevitable. Fraud patterns constantly change as fraudsters generate new ways to exploit vulnerabilities. Therefore, you must stay vigilant and implement robust fraud prevention solutions. Start by choosing one of our fraud detection tools that best suits your business.

We offer various decision-making instruments and techniques, such as advanced machine learning algorithms, behavioral and data analysis, risk scoring, and policy application. You can customize your setup to find the optimum balance in managing consumer friction and fraud detection. It will help you decrease fraud, increase conversion and protect your revenue!

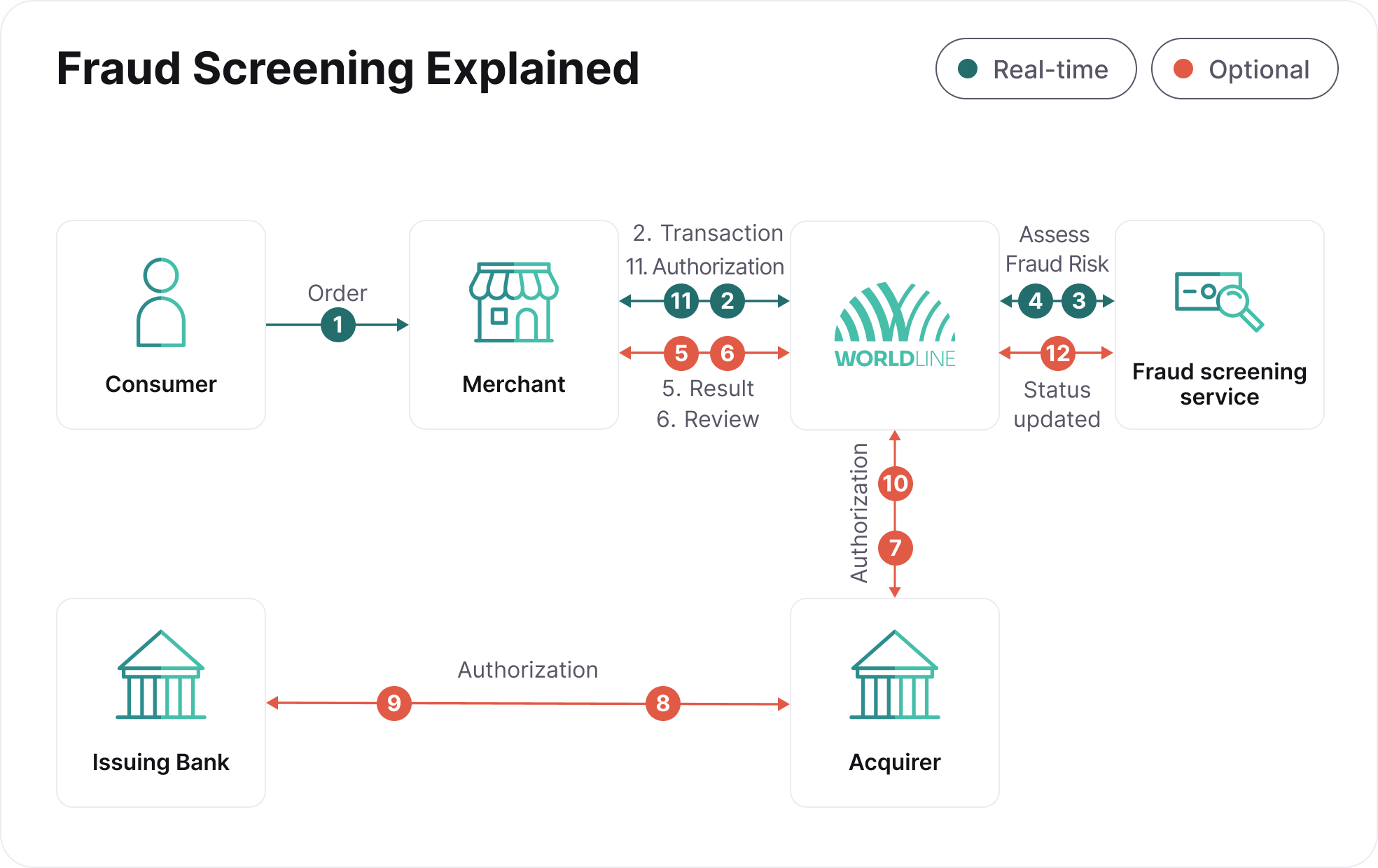

How does it work

Transactions are screened in real time according to your risk thresholds to detect as much fraud as possible, which gives you the basis for deciding whether to continue with transactions, review them for more details, or deny them. No additional integration steps are required from your side.

- Consumer selects a payment method and makes a transaction with you.

- You send us the transaction (and payment details, such as billing and shipping address, industry-specific information if applicable, etc.) to process your payment.

- We send all the provided data fields to the fraud screening tool you chose for risk assessment.

- The fraud screening tool returns a fraud result based on the risk thresholds set up in the tool.

- If the fraud screening tool returns fraud result = accepted, continue to Step 7

- If the fraud screening tool returns fraud result = denied. We return the request-response result to you, and the transaction won't be sent for authorization. The response will include details of your risk assessment. You'll need to inform the consumer that the transaction can't be processed successfully

- If the fraud screening tool returns fraud result = challenged, continue to Step 5

- A case is created for you, and we return a response informing you that the transaction needs to be reviewed.

- You review the transaction details and decide to continue or stop it because it's potentially fraudulent.

- If you decide to continue, proceed to Step 7

- If you decide to stop, the transaction won't be sent for authorization. The response will include details about your risk assessment. You'll need to inform the consumer that the transaction can't be processed successfully

- The transaction will be passed to the relevant acquiring channel for authorization.

- The acquirer redirects the authorization request to the card-issuing bank.

- The card-issuing bank processes the transaction in real time, returning the approved or declined response.

- The acquirer sends the authorization result to us.

- We return the request-response result to you. If the request is authorized, you can release the product or service to the consumer. The response will include details about your risk assessment.

- We'll send the final transaction status received from the acquirer to the fraud screening tool.

How to get started

Step 1: Choose your fraud strategy

Set up your rules to identify potential fraudulent activity and define your risk thresholds to trigger the appropriate decision (accept, deny, or send to case management for review). Our fraud manager can advise on what tools will help you achieve your fraud prevention and payment conversion goals: rules-based approach, machine learning solution, or hybrid solution. You can manually adjust your rules to:

- decrease false positive decisions, maintaining the balance of blocking illegitimate transactions

- train the models to use data for identifying emerging fraud patterns and stop fraud in real time

- leverage machine learning

Step 2: Choose the right tool

Our team of experts will partner with you to manage and optimize your fraud prevention strategies and train you to use these tools for the best benefit. Based on your business setup, fraud strategy, and the support you need, choose between one of our fraud detection offerings.

Step 3: Validate your integration

You need no additional integration to add fraud detection for payments processed with us. Ensure you're sending all the required data to fight fraud effectively. You can also review the responses we received, showing what rule was triggered for the final decision to take place.

Cybersource Decision Manager

- Insights from 296 billion Visa transactions

- Adaptation to new fraud patterns & consumer behaviors

- Over 260 fraud detectors, including device fingerprinting and IP geolocation

- Real-time machine learning

- Clear explanations for high fraud scores with detailed codes

- Automatic generation of recommended fraud rules using machine learning

ACI Fraud Management Tool

- Seamless integration into the payment process

- Creating simple or complex rules

- Advanced reporting to analyze fraud patterns

- Setting up of block and trust lists

- Reviews of risky transactions before accepting them