Ordering of payment products

What is payment product ordering?

The payment product ordering feature enables you to customize the order in which payment options are displayed to your consumers. You can specify which payment products to prioritize and present first based on consumers' preferences in different countries. This feature allows you to highlight the most preferred payment product at the top.

How do your consumers see the order of payment products?

The order depends on where the payment product selection page is shown to your consumers. You can easily display your defined order of payment products on:

- payment product selection page within the MyCheckout hosted payment pages of Connect

- your own custom payment product selection page

Payment product selection on the MyCheckout hosted payment pages

If you use the MyCheckout hosted payment pages, the order of payment products will automatically appear to your consumers as you have configured it in the Configuration Center of Connect. This order is determined based on the country code associated with the transaction.

Your own payment product selection page

If you created your own webpage where consumers can choose their preferred payment product, you can use the information provided in the GET paymentProduct(s) API call. This call supplies you with the optimal display order for the products, indicating the sequence through the displayOrder property. In this property, "0" represents the first product to display, "1" is the second, and so on, with the index starting at 0.

How to adjust the order of payment products

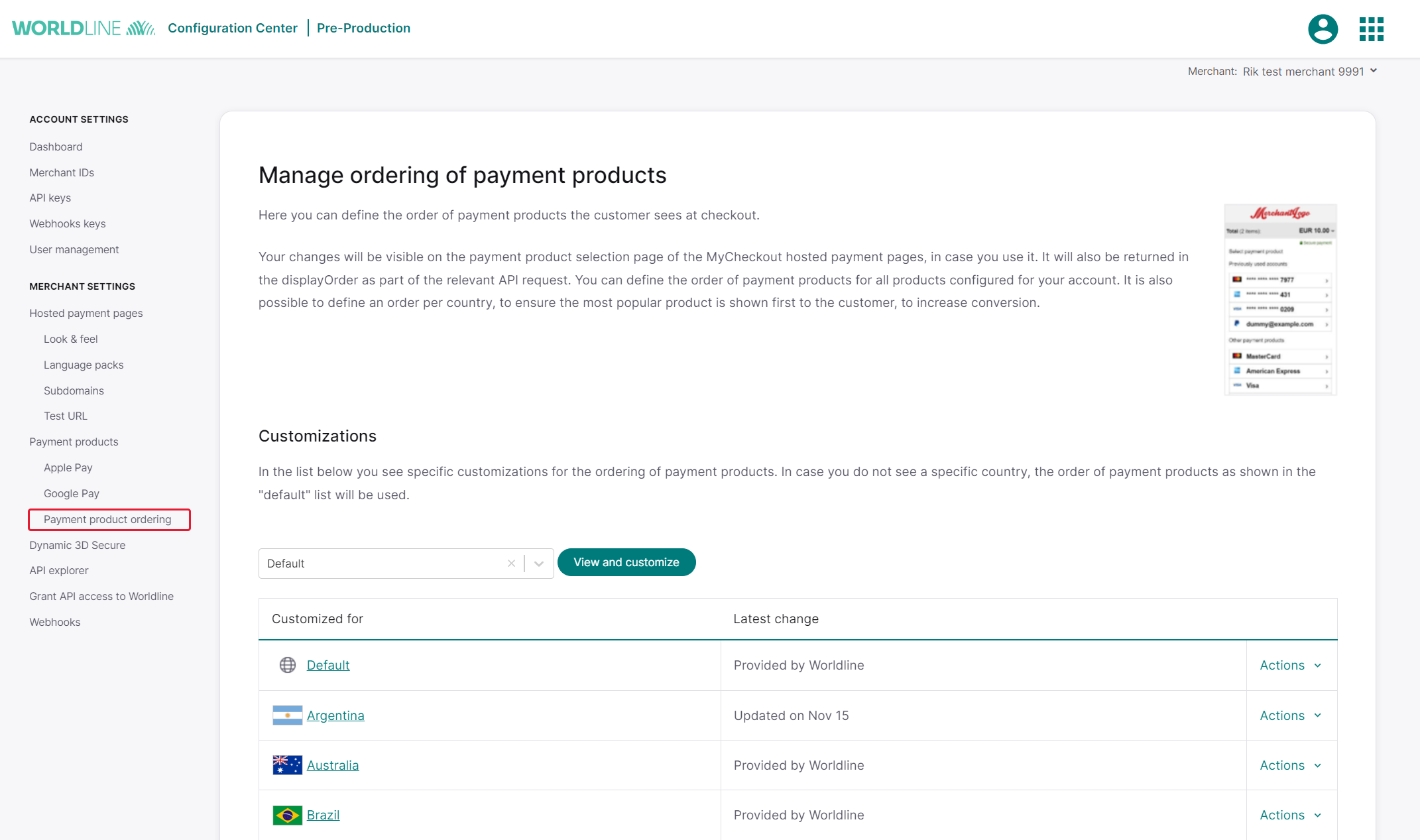

- Log in to the Configuration Center.

- Select the merchant ID located at the top right corner for which you want to make the customization.

- Navigate to Merchant settings > Payment products > Payment product ordering.

In the table, you'll find two lists: the default list and country-specific lists for certain countries, both provided by us. We allow you to modify any of these lists, including the default one. Additionally, you have the option to create your custom list for any country that doesn't already have one provided by us.

Default order of payment products

The default list contains all the payment products configured for your merchant ID and is used for any country that does not have a customized payment products order. If you adjust the order in the default list, these changes will apply to all countries for which you have not set a specific order of payment products.

Country-specific lists

We've created specific lists of payment product orderings for certain countries, including:

- Argentina

- Australia

- Brazil

- Canada

- China

- France

- Germany

- India

- Japan

- Mexico

- Netherlands

- South Korea

- Turkey

- United Kingdom

- USA

How to adjust the order of payment products

- Use the dropdown menu to select:

-

- the country for which you want to adjust the order

- the default option

- Once selected, view the table below the dropdown, which displays countries with customized orders of payment products.

- To change the order, click the "Actions" button and select "Edit."

- In the pop-up, locate the grey customization section labeled "Move here to prioritize." Add the payment products you want to appear first by clicking on them or dragging and dropping them in this section.

- After adding products to the grey section, adjust their order by:

-

- dragging them up or down within the list

- clicking the three dots on the right and using the arrow to move a product up or down

- To reset a product to the default order, click the "X" button next to the product.

Note: any products not moved to the customization section will appear to consumers in the order displayed in the Configuration Center, based on the transaction's country and currency.

- Once you have finalized your changes, save them to ensure they take effect immediately.

Removing your customized order of payment products

- Scroll to the country for which you want to remove the customization.

- Click on "Actions" and then select "Delete."

- Once you click "Delete," the changes will take effect immediately, and your consumers will see the default order.

Customization and showing cards as one payment option

If you're using our MyCheckout hosted payment pages and displaying "cards" as a payment option on the payment product selection page, you can reproduce this view in the customization section. Simply click on "Group card products" to achieve this.

After prioritizing the cards and selecting the "Group card products" option, they will appear as a single option in the grey customization area.

Please note that the feature to display "cards" as a single payment method is available exclusively in the MyCheckout editor. To enable this feature, follow these steps:

- Go to "Merchant Settings" in the Configuration Center.

- Select "Look and Feel" under "Hosted Payment Pages."

- Choose the variant you want to modify.

- The MyCheckout editor will open.

- Go to "Variant Settings" and select the "Group Cards" option.

- Press "Save" and then "Publish."

Getting the order for all payment products

The GET payment products call allows you to retrieve all relevant payment products, based on your configuration and provided filters (like country and currency). Below you see an example of the request for the United States of America and the US Dollar.

GET https://{domainname}/v1/{yourmerchantId}/products?countryCode=US¤cyCode=USDWhen you receive the response from this call, you will notice that each payment product includes a displayHints property with a displayOrder number. This number tells you where to position the payment product on your selection page - the lower the number, the higher the placement.

For example, in the response below:

- Visa has a displayOrder of 0 and should be displayed first

- Mastercard is next, followed by American Express

- UnionPay, JCB, Discover, Diners Club, and Visa Debit come next

- PayPal is displayed last

{

"paymentProducts" : [ {

"deviceFingerprintEnabled" : true,

"allowsInstallments" : false,

"allowsRecurring" : false,

"allowsTokenization" : true,

"authenticationIndicator" : {

"name" : "AUTHENTICATIONINDICATOR",

"value" : "1"

},

"autoTokenized" : false,

"displayHints" : {

"displayOrder" : 0,

"label" : "Visa",

"logo" : "templates/master/global/css/img/ppimages/pp_logo_1_v2.png"

},

"id" : 1,

"maxAmount" : 10145020000,

"mobileIntegrationLevel" : "OPTIMISED_SUPPORT",

"paymentMethod" : "card",

"paymentProductGroup" : "cards",

"usesRedirectionTo3rdParty" : false

}, {

"deviceFingerprintEnabled" : false,

"allowsInstallments" : false,

"allowsRecurring" : false,

"allowsTokenization" : true,

"authenticationIndicator" : {

"name" : "AUTHENTICATIONINDICATOR",

"value" : "1"

},

"autoTokenized" : false,

"displayHints" : {

"displayOrder" : 1,

"label" : "MasterCard",

"logo" : "templates/master/global/css/img/ppimages/pp_logo_3_v3.png"

},

"id" : 3,

"maxAmount" : 10082050,

"mobileIntegrationLevel" : "OPTIMISED_SUPPORT",

"paymentMethod" : "card",

"paymentProductGroup" : "cards",

"usesRedirectionTo3rdParty" : false

}, {

"deviceFingerprintEnabled" : false,

"allowsInstallments" : false,

"allowsRecurring" : false,

"allowsTokenization" : true,

"authenticationIndicator" : {

"name" : "AUTHENTICATIONINDICATOR",

"value" : "1"

},

"autoTokenized" : false,

"displayHints" : {

"displayOrder" : 2,

"label" : "American Express",

"logo" : "templates/master/global/css/img/ppimages/pp_logo_2_v2.png"

},

"id" : 2,

"maxAmount" : 1014502,

"mobileIntegrationLevel" : "OPTIMISED_SUPPORT",

"paymentMethod" : "card",

"paymentProductGroup" : "cards",

"usesRedirectionTo3rdParty" : false

}, {

"deviceFingerprintEnabled" : false,

"allowsInstallments" : false,

"allowsRecurring" : false,

"allowsTokenization" : true,

"authenticationIndicator" : {

"name" : "AUTHENTICATIONINDICATOR",

"value" : "0"

},

"autoTokenized" : false,

"displayHints" : {

"displayOrder" : 3,

"label" : "UnionPay",

"logo" : "templates/master/global/css/img/ppimages/pp_logo_56_v1.png"

},

"id" : 56,

"maxAmount" : 10145020000,

"mobileIntegrationLevel" : "OPTIMISED_SUPPORT",

"paymentMethod" : "card",

"paymentProductGroup" : "cards",

"usesRedirectionTo3rdParty" : false

}, {

"deviceFingerprintEnabled" : false,

"allowsInstallments" : false,

"allowsRecurring" : false,

"allowsTokenization" : true,

"authenticationIndicator" : {

"name" : "AUTHENTICATIONINDICATOR",

"value" : "1"

},

"autoTokenized" : false,

"displayHints" : {

"displayOrder" : 4,

"label" : "JCB",

"logo" : "templates/master/global/css/img/ppimages/pp_logo_125_v1.png"

},

"id" : 125,

"maxAmount" : 1014502,

"mobileIntegrationLevel" : "OPTIMISED_SUPPORT",

"paymentMethod" : "card",

"paymentProductGroup" : "cards",

"usesRedirectionTo3rdParty" : false

}, {

"deviceFingerprintEnabled" : false,

"allowsInstallments" : false,

"allowsRecurring" : false,

"allowsTokenization" : true,

"authenticationIndicator" : {

"name" : "AUTHENTICATIONINDICATOR",

"value" : "1"

},

"autoTokenized" : false,

"displayHints" : {

"displayOrder" : 5,

"label" : "Discover",

"logo" : "templates/master/global/css/img/ppimages/pp_logo_128_v1.png"

},

"id" : 128,

"maxAmount" : 1014502,

"mobileIntegrationLevel" : "OPTIMISED_SUPPORT",

"paymentMethod" : "card",

"paymentProductGroup" : "cards",

"usesRedirectionTo3rdParty" : false

}, {

"deviceFingerprintEnabled" : false,

"allowsInstallments" : false,

"allowsRecurring" : false,

"allowsTokenization" : true,

"authenticationIndicator" : {

"name" : "AUTHENTICATIONINDICATOR",

"value" : "1"

},

"autoTokenized" : false,

"displayHints" : {

"displayOrder" : 6,

"label" : "Diners Club",

"logo" : "templates/master/global/css/img/ppimages/pp_logo_132_v1.png"

},

"id" : 132,

"maxAmount" : 10145020000,

"mobileIntegrationLevel" : "OPTIMISED_SUPPORT",

"paymentMethod" : "card",

"paymentProductGroup" : "cards",

"usesRedirectionTo3rdParty" : false

}, {

"deviceFingerprintEnabled" : true,

"allowsInstallments" : false,

"allowsRecurring" : false,

"allowsTokenization" : true,

"authenticationIndicator" : {

"name" : "AUTHENTICATIONINDICATOR",

"value" : "1"

},

"autoTokenized" : false,

"displayHints" : {

"displayOrder" : 7,

"label" : "Visa Debit",

"logo" : "templates/master/global/css/img/ppimages/pp_logo_114_v2.png"

},

"id" : 114,

"maxAmount" : 10145020000,

"mobileIntegrationLevel" : "OPTIMISED_SUPPORT",

"paymentMethod" : "card",

"paymentProductGroup" : "cards",

"usesRedirectionTo3rdParty" : false

}, {

"deviceFingerprintEnabled" : false,

"allowsInstallments" : false,

"allowsRecurring" : false,

"allowsTokenization" : false,

"autoTokenized" : false,

"canBeIframed" : false,

"displayHints" : {

"displayOrder" : 8,

"label" : "PayPal",

"logo" : "templates/master/global/css/img/ppimages/pp_logo_840_v1.png"

},

"id" : 840,

"mobileIntegrationLevel" : "OPTIMISED_SUPPORT",

"paymentMethod" : "redirect",

"usesRedirectionTo3rdParty" : true

} ]

}

Obtaining the order for one payment product

The GET payment product call focuses on retrieving information for a specific payment product, as opposed to the GET payment products call which returns information about all payment products configured for the currency and country specified in your request. Here's what happens:

- You specify the payment product you're interested in

- The call returns detailed information just for that product

Below, you can see how this works using PayPal as an example.

GET https://{domainname}/v1/{yourmerchantId}/products/840?countryCode=US¤cyCode=USD

When you receive the response, look for the displayHints property, which includes a displayOrder. The displayOrder is a number that helps you prioritize how you list payment products to your consumers — the lower the number (starting with 0), the higher the product should be placed on the list.

For instance, a displayOrder of 8 means that the product should be placed relatively lower on the list. To understand the complete ranking for all products, you will need to make a separate GET payment product call for each payment product. However, it will be quicker to get a detailed view of how to order the products efficiently with the GET payment products call.

{

"deviceFingerprintEnabled" : false,

"allowsInstallments" : false,

"allowsRecurring" : false,

"allowsTokenization" : false,

"autoTokenized" : false,

"canBeIframed" : false,

"displayHints" : {

"displayOrder" : 8,

"label" : "PayPal",

"logo" : "templates/master/global/css/img/ppimages/pp_logo_840_v1.png"

},

"id" : 840,

"mobileIntegrationLevel" : "OPTIMISED_SUPPORT",

"paymentMethod" : "redirect",

"usesRedirectionTo3rdParty" : true

Regulation in Sweden

In Sweden the Payment Services Act (2010: 751) came into force. It requires that the payment product which is presented first in a situation where a consumer makes a purchase online, is a payment product that does not involve credit.

To adhere to this regulation, the order of payment products your consumer in Sweden will see, is based on the payment products you have configured on your merchantID and will be shown based on below order.

| paymentProductId | Payment product name |

|---|---|

| 806 | Trustly |

| 830 | paysafecard |

| 840 | PayPal |

| 843 | Skrill |

| 11 | Bank transfer |

In case you do not have Trustly configured, we will show paysafecard first to your consumers. In case you have neither of these, we will show PayPal first. If none of these products have been configured for your merchantID, either the default payment product ordering will apply or your customized order for Sweden.

If any of these products are configured for your merchant ID, the one higher up in the list will be shown first to your consumer and can't be changed to another position in the payment product ordering customization. If none of these products have been configured, then the default payment product order will apply or your customized order for Sweden.

For example, if you have PayPal and bank transfer configured on your merchant ID and not the other payment products, the first payment product will always be PayPal. You can prioritize bank transfer in any place you desire, but not above PayPal.

Regulations in Finland

The Finnish Consumer Protection Act (No. 38 of 1978) mandates a specific order for displaying payment products to a consumer during online purchases. Here's how it should be presented:

- Payment products that do not include the possibility of applying for or using credit

- Payment products that may include the possibility of applying for or using credit (e.g., combined cards with both debit and credit features)

- Payment products that involve applying for or using credit

To adhere to this regulation, the order of payment products your consumer in Finland will see is based on the payment products you have configured on your merchant ID and shown based on the below order.

| paymentProductId | Payment product name |

|---|---|

| 806 | Trustly |

| 802 | Nordea Finland |

| 865 | Worldline Account-to-Account Payments |

| 830 | paysafecard |

| 840 | PayPal |

| 861 | Alipay |

| 863 | WeChat Pay |

- If Trustly isn't set up, Nordea Finland will be the first option displayed

- Without Trustly or Nordea Finland, the default is Worldline Account-to-Account Payments

- If none of these are configured, either a default payment order or your custom order for Sweden will be used

When multiple payment products are configured for your merchant ID, they will be shown in the order listed above. This order is fixed and cannot be customized. If none of these products are set up, then either the default order or your custom order for Finland will be used.

For instance, if you have configured PayPal and WeChat Pay for your merchant ID and not the others, PayPal will always appear first. You can place WeChat Pay wherever you prefer in the list, but it cannot be prioritized over PayPal.

Which order will be shown to your consumers?

The order of payment products your consumer sees, depends on whether you have made changes to the order of a specific country or the order of the default list:

- Your customized order of payment products for a specific country will be used

- If you have not made your own customization, the order of payment products for a specific country which is created by Worldline will be used

- If there is no customization for a specific country made by either you or Worldline, your customized default order of payment products will be used

- If there is no customization for a specific country made by either you or Worldline and you have not made changes to the default order of payment products, the default order of payment products created by Worldline will be used.

As explained above, due to the regulations in Sweden and Finland, your consumer will see a non-credit payment product first, irrespective of any customization you made.

The table below explains the priority each order of payment products has over the other, where first priority 1 will be shown and if not applicable, priority 2 etcetera.

| Priority | Which order of payment products | Explanation | Example |

|---|---|---|---|

| 1 | Regulatory requirement | Currently only Sweden requires a non-credit payment product to be shown first | Sweden, Finland |

| 2 | Your customized order for a specific country | Your customization for a specific country will be shown to the consumers of that specific country | Germany, United States |

| 3 | Worldline's order for a specific country | Worldline's order for a specific country The order of payment products as defined by Worldline will be shown | China, Japan |

| 4 | Your customized default order | Your customization of the default order for all countries will be shown to your consumers, based on the country they are in | Default |

| 5 | Worldline's default order | Worldline's default order The default order for all countries will be shown to your consumers, based on the country they are in | Default |