Dynamic 3D secure

What is Dynamic 3D Secure?

Dynamic 3D Secure allows you to define for which transactions you want 3D Secure to be executed, allowing this to be only done in cases where 3D Secure is expected to have an added value or where 3D Secure does not impact the conversion. It is an easy feature that allows you to define transaction criteria, in rules, for which you want 3D Secure flow to be activated. There is no need for development to use it. You can use Dynamic 3D Secure in Connect on the GlobalCollect platform.

On transactions it is possible to perform 3D Secure. 3D Secure is an abbreviation for Three Domain Secure, which is the card schemes Internet Authentication Standard. All major credit card brands support this standard under their own label, like for instance Verified by Visa and Mastercard SecureCode. If 3D Secure is enabled, a consumer is redirected to their card issuer's website to verify their identity. By using 3D secure it is possible to reduce fraud, which is of course great. Unfortunately it can also cause consumers to abandon the checkout process, due to the additional step which 3D Secure adds. If a consumer does not complete his or her payment due to 3D Secure, you might gain less revenue. So the choice is the trade off between 'preventing charge back' and 'less conversion on checkout'.

Options to use 3D Secure to your advantage

If 3D Secure is enabled on our platform for your account, by default the 3D Secure flow will be followed for all transactions. In case you do not want this to happen on all your transactions, you can choose to:

- Skip the 3D Secure flow by using flags in the API. This requires full development and maintenance by developers on your side.

- Use Dynamic 3D Secure. You can easily configure whether you want the 3D Secure flow to be executed, which is explained below.

Benefits and key features of Dynamic 3D Secure

- What are the benefits of Dynamic 3D Secure?

- Increase the conversion by setting rules that define for which transactions 3D Secure is used;

- The ability to balance between fraud protection using 3D Secure and overall checkout experience;

- High level of customization possible based on transaction parameters.

- Key features

- Easy way to define when 3D Secure should be used for a transaction;

- High level of customization possible to define the criteria for which 3D Secure must be turned on;

- No additional costs are charged to use Dynamic 3D Secure;

- Ready to use, without additional development.

When to use Dynamic 3D Secure?

You can for example decide that only for amounts above EUR 500 you want 3D Secure to be executed. This can be achieved with a specific rule in the configuration center. It might also be possible that you would want 3D Secure to be executed on one specific payment product, for which you have experienced an overall higher level of chargebacks.

Products for which Dynamic 3D Secure can be used

Dynamic 3D Secure only works for card products, for which 3D Secure is supported on our platform.

3D Secure is mandatory for:

- India;

- Maestro;

- transaction in Australia above $200;

- Italian merchants doing business with Italian consumers.

Using Dynamic 3D Secure

Before using Dynamic 3D Secure you must:

- Use Connect;

- Process your payments through the GlobalCollect platform;

- Have 3D Secure enabled for your merchantID;

Configuring Dynamic 3D Secure

In order to enable Dynamic 3D Secure, you need to:

- Login to the configuration center;

- Go to the menu item Dynamic 3D Secure;

- Add a rule;

- Define the criteria for which transactions you want 3D Secure to be triggered;

- Activate the rules that you want your payments to be evaluated against;

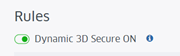

- Enable Dynamic 3D Secure with the toggle on the page in the configuration center.

Step 1. Login to the configuration center

Log in to the configuration center with your account.

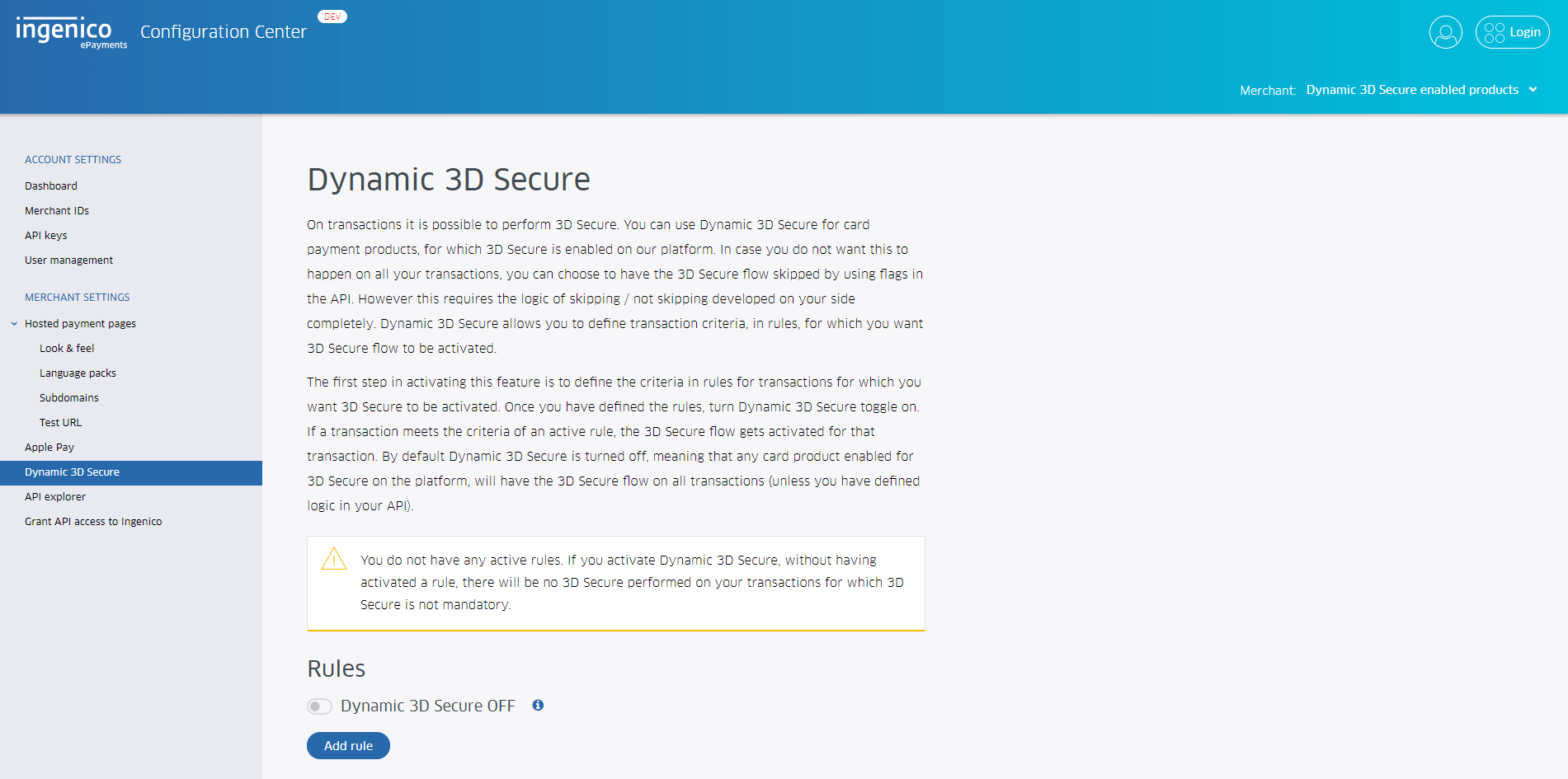

Step 2. Go to the menu item Dynamic 3D Secure

Go to the menu item Dynamic 3D Secure.

Step 3. Add a rule

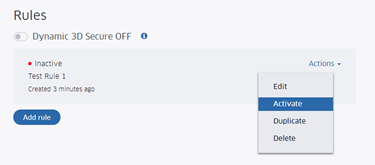

A rule needs at least one criterium in order to be able to save it. A rule is by default not activated. It needs to be manually put to active from the overview screen (see step 5).

Step 4. Define the criteria for which transactions you want 3D Secure to be triggered

Be aware that:

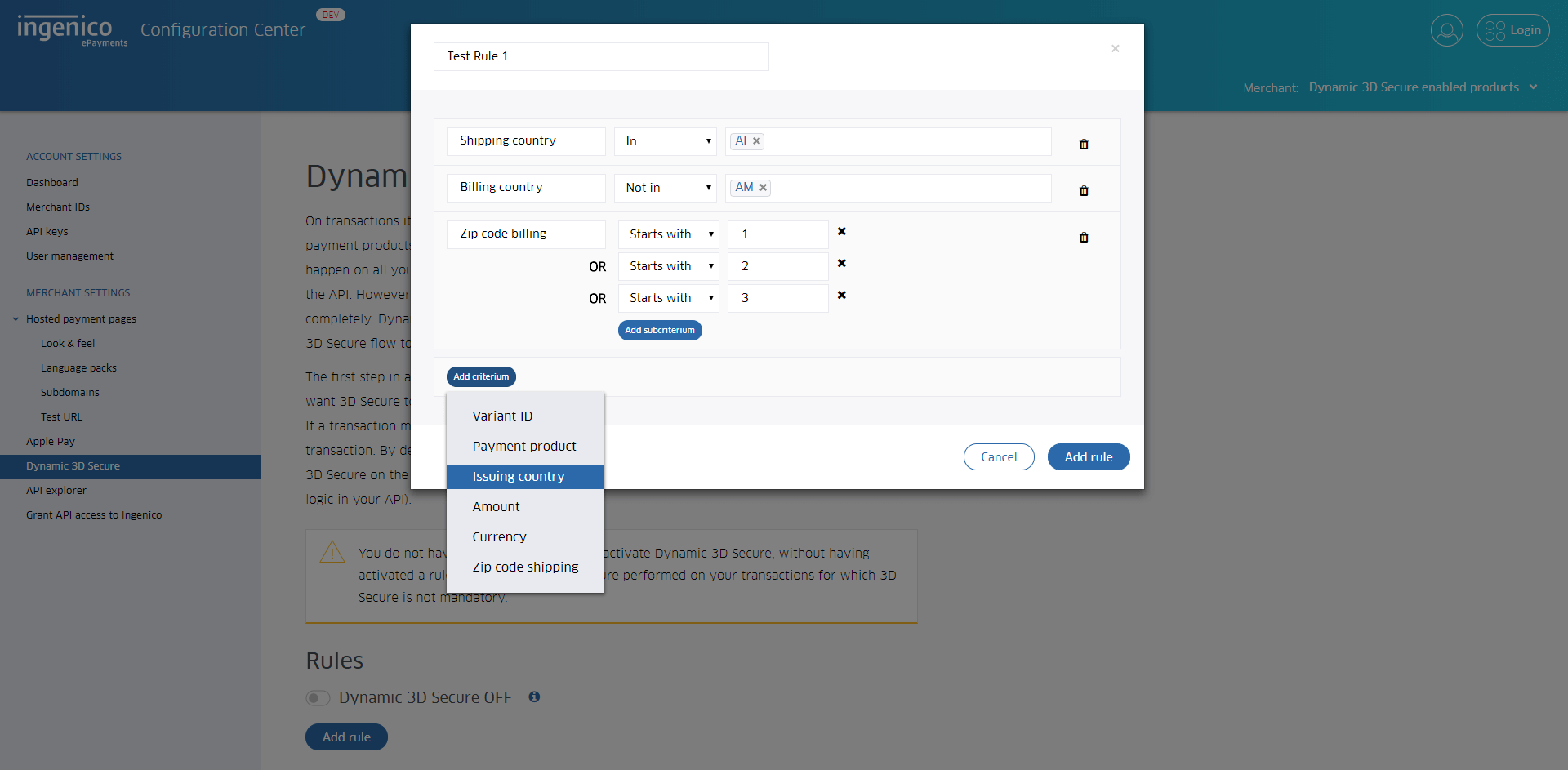

- Per criterium you can define a value;

- It is possible to add multiple criteria in one rule;

- We use the AND evaluation between criteria in a rule, so there can only be one of each type of criteria;

- Inside a criterium of type zip code we use the OR evaluation.

Things you should know about:

Rules

- A rule contains the logic set of criteria

- The following actions apply to a rule:

- Activate/deactivate;

- Duplicate;

- Delete.

- The rules are ordered on active/inactive and then alphabetical on name.

Criteria

- A criterium is a parameter which can get a value to define based on what the 3D Secure flow will be executed;

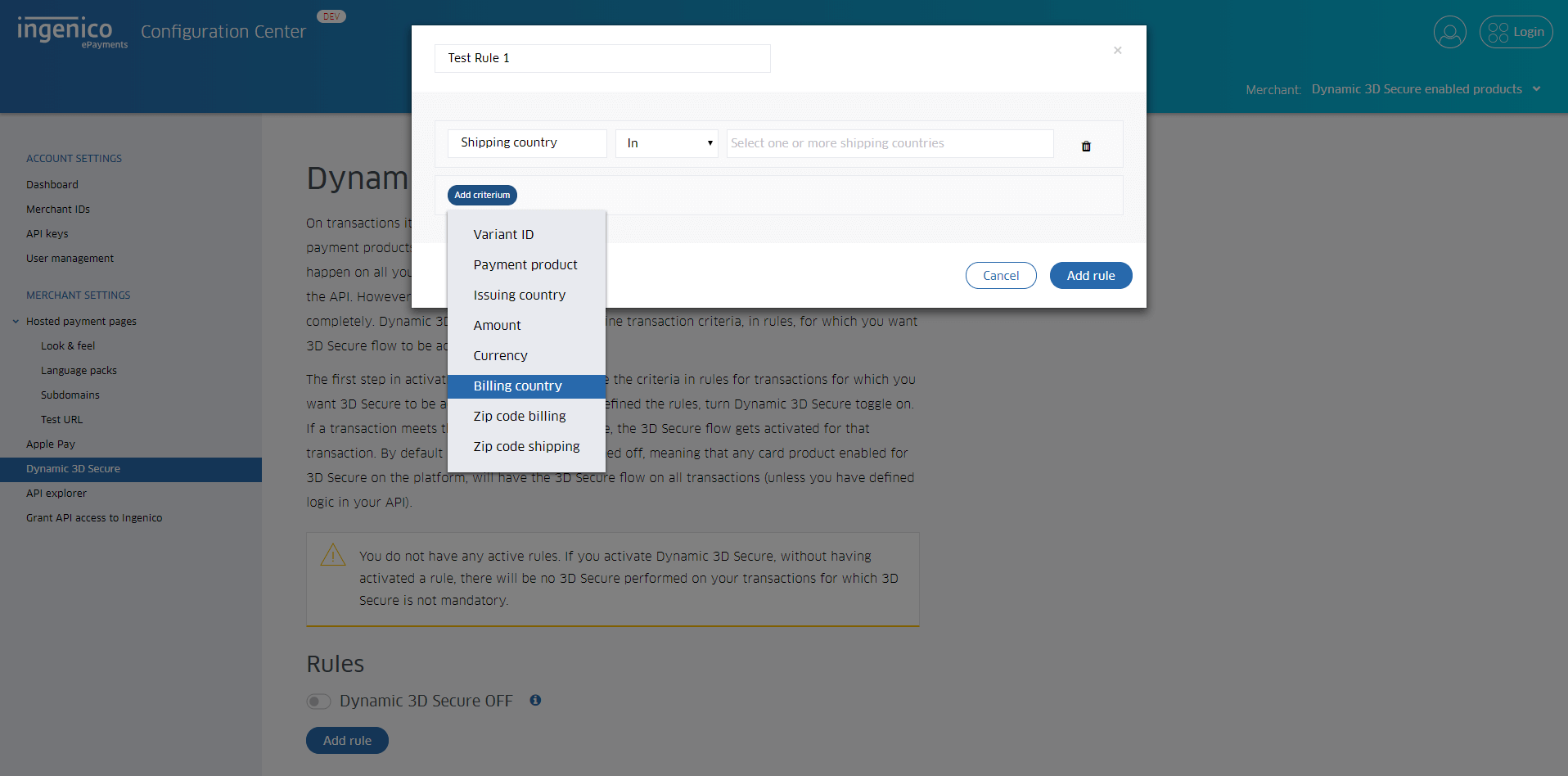

- With the add criterium button you get a drop down list with the available criteria types to add to the rule. Because of the AND evaluation we use between the criterias in a rule, there can only be ONE of each type of criteria;

- One single zip code criterium will behave like an OR evaluation internally.

- The following criteria can be defined:

- Variant ID: the variant of the MyCheckout hosted payment pages;

- Payment product: the product for which you can define a criterium;

- BIN: the first six digits of the card number of the consumer;

- Issuing country: the country in which the card was issued;

- Amount: the amount of the transaction in 1 full payment unit, in cents, not full e.g. Euro's;

- Currency: the currency type of the transaction amount;

- Billing country: the country to where the bill will be send;

- Shipping country: the country to where the goods are shipped;

- ZIP code: the ZIP code of the consumer.

Evaluation types of criteria

Criteria are evaluated by their respective types. The following types are currently supported:

| Criteria | Evaluation types | Important |

|---|---|---|

|

Variant |

In, Not In | |

| Payment product | In, Not In | |

| BIN | Starts with | |

| Currency | In, Not In | |

| Amount (in cents) | Greater than or equal to | |

| Issuing country | In, Not In | When the issuing country code cannot be determined for the card of the payment by the IIN service, the rule with this criterium will never hit for the payment that is evaluated. |

| Billing country | In, Not In | |

| Shipping country | In, Not In | |

| ZIP code | Equals, Contains, Starts with, Ends with and Regular Expression |

Example: 'Currency In "AUD|DKK|EUR"' checks if a payments' currency is AUD, DKK or EUR, whilst 'Currency Not In "AUD|DKK|EUR"' checks if a payments currency is not AUD, DKK or EUR.

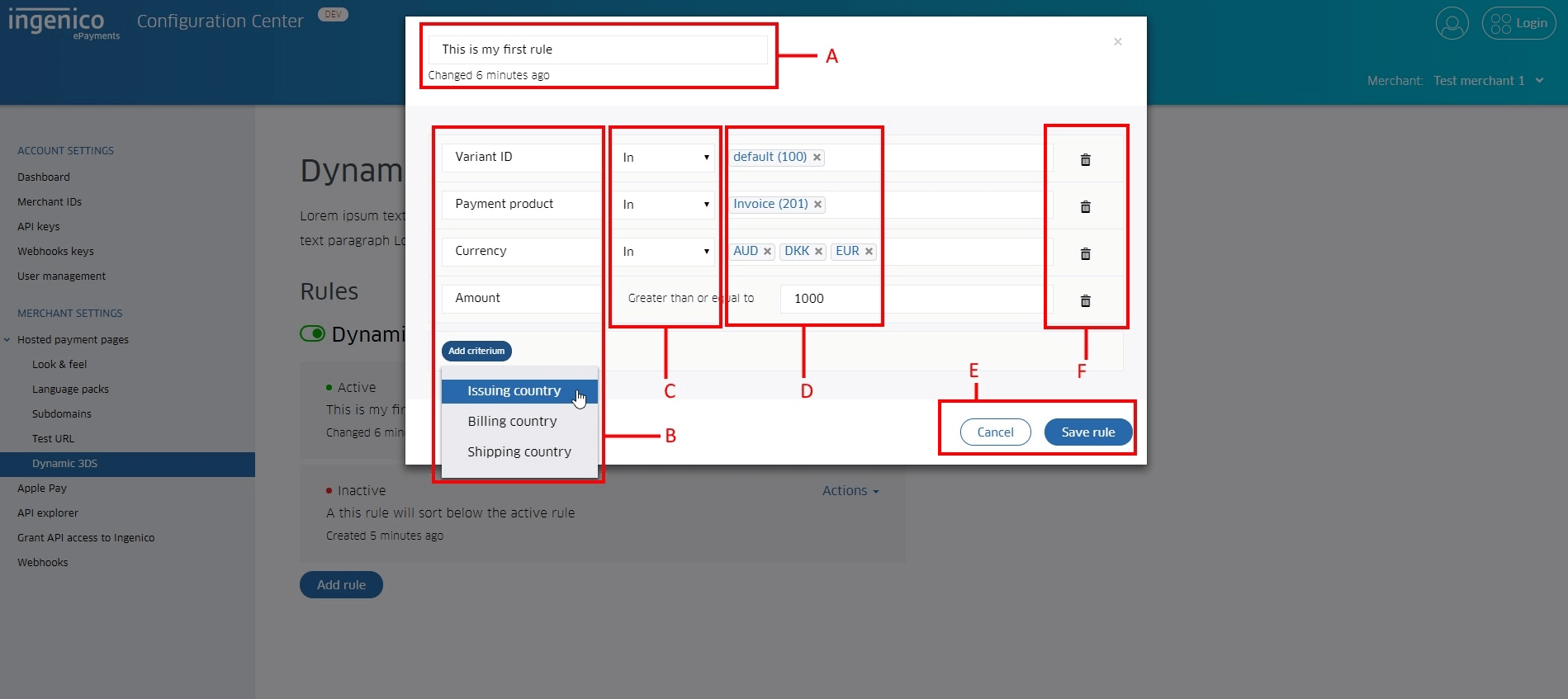

More detailed explanation on the Rule detail screen:

- Name of the rule

- Criteria

- Evaluation types of criteria

- Evaluation values

- Save and cancel button

- Delete option for a criteria

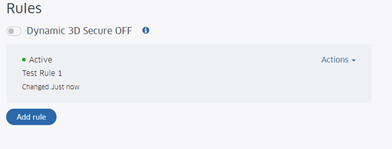

Step 5. Activate the rules that you want your payments to be evaluated against

This allows you to very securely pick the rules you want to have in place.

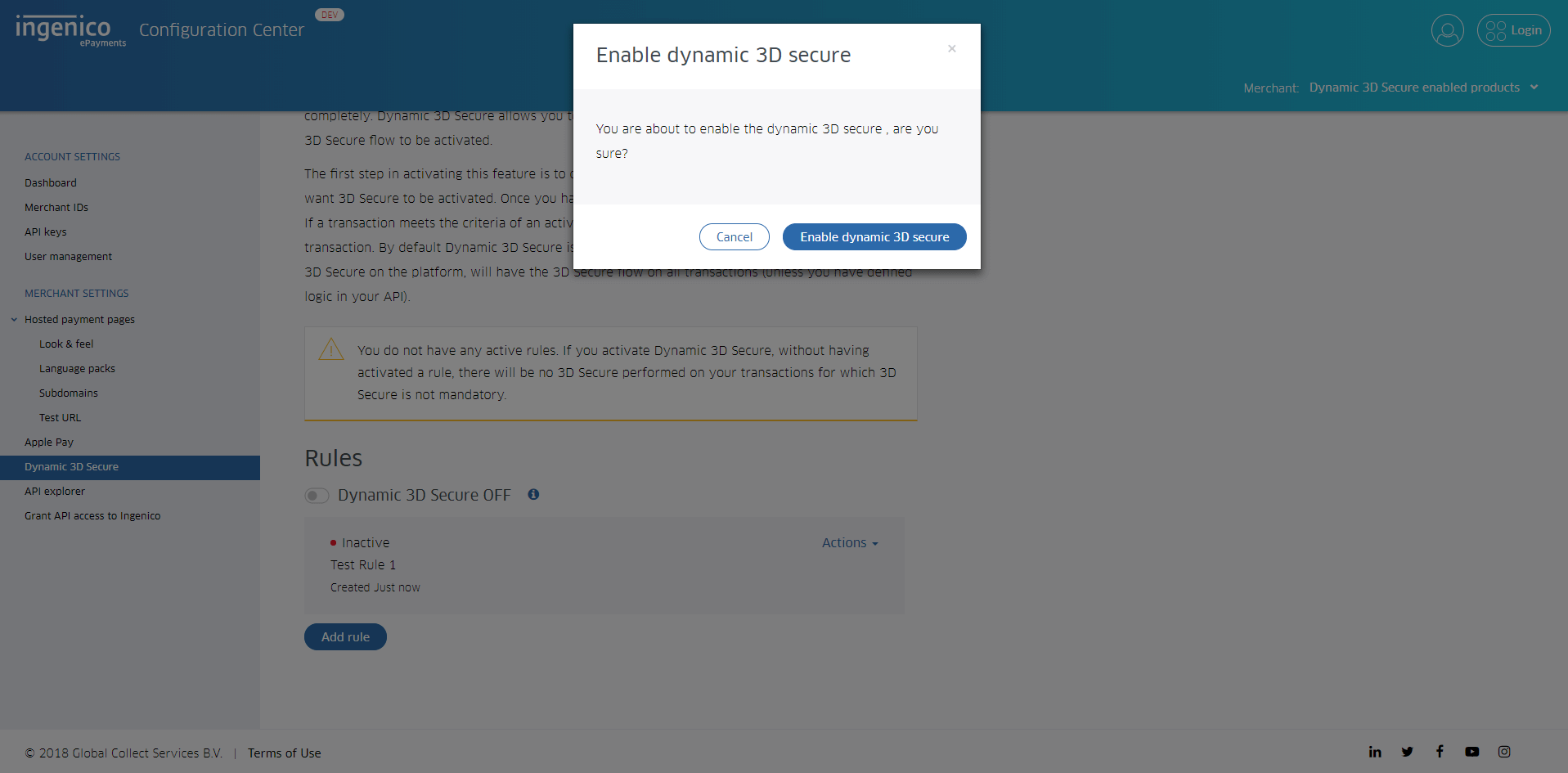

Step 6. Enable Dynamic 3D Secure with the feature toggle

When Dynamic 3D Secure is turned

- Off

- All payments are handled as they were

- On

- Settings can take up to maximum 10 minutes to take effect;

- Activated rules apply to the transactions;

- If no rules apply, 3D Secure will be skipped;

- If any rule applies to a specific transaction, 3D Secure will be triggered;

- The Dynamic 3D Secure only works for the following card schemes: AMEX, Mastercard and VISA.

Now clicking Enable Dynamic 3D Secure shows this afterwards:

Using Dynamic 3D Secure

So now that you have configured the Dynamic 3D Secure rules and activated the Dynamic 3D Secure functionality, your transactions for the correctly configured payment products will be evaluated against the configured and activated rules.

Impact on your payment flow

Important things to take notice of:

- When Dynamic 3D Secure is disabled, we will just continue the original payment flow. No additional checks are executed.

- When you have Dynamic 3D Secure enabled and you have no rules defined, you will always skip 3D Secure authentication for every paymentproduct that supports Dynamic 3D Secure evaluation.

When you have Dynamic 3D Secure enabled, and you have rules defined the following happens:

- An iteration is done over all rules that you marked as active and we look if any of the rules is hit. (Hit in this context means that for one rule, all defined criteria are hit with the payment that is being evaluated.)

- If any rule is hit, the 3D Secure redirect will be triggered;

- If no rules are hit, the 3D Secure will not be triggered.