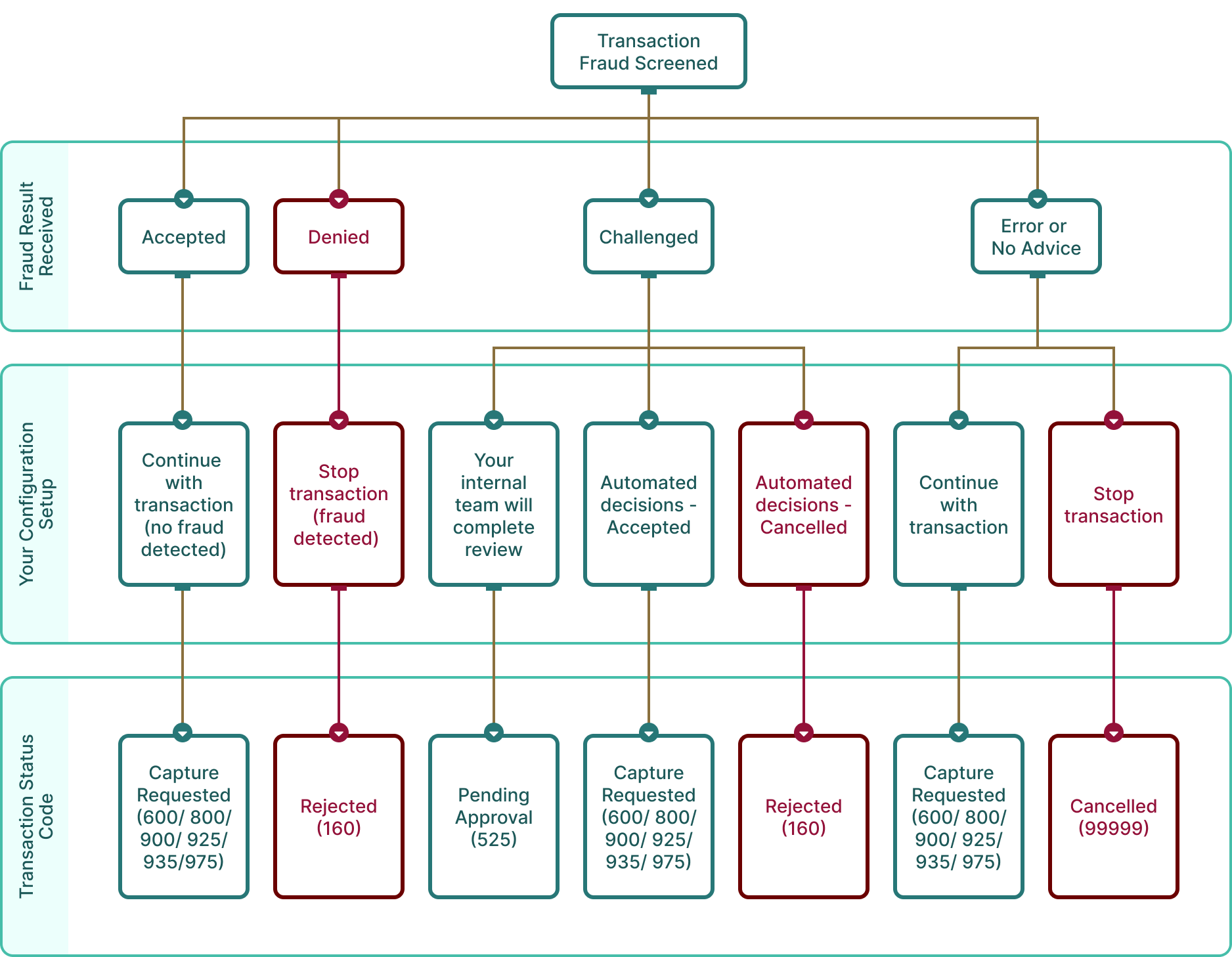

Fraud status codes

Once you complete your setup, the transactions processed with us get sent for risk evaluation to detect any suspicious or fraudulent activity. In the received response, you can expect one of these results:

| Accepted | The payment is not fraudulent since rules are not triggered. It will be routed to Authorization. The fraudserviceResult field will be set to the value = Accepted |

| Denied | The payment is most likely fraudulent based on the triggered rule. It will be stopped and will not proceed to Authorization. The fraudserviceResult field will be set to the value = Denied |

| Challenged | The payment is more likely to be fraudulent, and a case will be created in a pending review queue. This will allow you to examine the transactional details associated with the payment and decide whether to proceed or deny it. The fraudserviceResult field will be set to the value = Challenged |

| No Advice | The fraud risk evaluation could not be executed as the fraud provider did not provide a response. The value = fraudserviceResult field will be set to the value = No advice |

| Error | There was a issue relating to the data sent in the request, the fraud risk evaluation could not be executed. The value = fraudserviceResult field will be set to the value = Error |

The manual review feature (triggered when the fraud result is returned as CHALLENGED) is only set up in your rules if you want your team to review any scenarios in detail before making a final decision. You can send a transaction to case management based on your risk rules or score. Discuss your case management needs with your fraud experts to help you find the balance to minimize fraudulent transactions while managing operational costs. The chart below summarizes the returned fraud results and the expected state of a transaction.