PHP SDK

Introduction

To understand how to use this SDK it is best to read the following documentation:

- Server Introduction

First read the Server Introduction to familiarize yourself with the various concepts. - Server API Reference

This Server SDK wraps the Server API and (amongst other things) exposes the responses of the webservice calls as PHP objects. Understanding the Server API will help you understanding these SDK objects as well. - This current document will help you understand the global flow when interacting with the Worldline platform using the PHP SDK.

The PHP SDK helps you to communicate with the Server API. More specifically, it offers a PHP API that provides access to all the functionality of the RESTful Server API. Below, we discuss the following topics in detail.

- Setting up Composer

- Initialization of the PHP SDK

- Payments

- File Service support

- Idempotent requests

- Exceptions

- Logging

- Advanced use: Connection Pooling

- Advanced use: Customization of the communication

- Advanced use: Proxy

- Webhooks

The source code of the SDK is available on Github . There you can find installation instructions.

The API documentation of the latest version of the SDK is available here . For a specific major version, replace latest with <major>.x. Note that this is only available for versions 7.x and later. For version 6.x use this URL instead.

Setting up Composer

Composer is a dependency management tool for PHP. It allows you to declare the libraries your project depends on and it will manage (install/update) them for you.

In order to use composer, you first need to initialize composer in your project:

composer initSee Introduction - Composer for more information on how to get started with Composer.

Next we need to install the PHP SDK with composer:

composer require worldline-global-collect/connect-sdk-phpComposer manages the dependencies on a per-project basis; running this command will create a directory called vendor containing all the installed dependencies.

Finally, make sure you've included the composer autoload file in your project before you're using the the classes:

require __DIR__ . '/vendor/autoload.php';All classes of the PHP SDK are compliant with PSR-4 . The PHP SDK uses root namespace Worldline\Connect\Sdk.

Initialization of the PHP SDK

All PHP code snippets presented in the API reference assume you have initialized the PHP SDK before using them in your Development Environment. This section details the initialization of the PHP SDK.

To initialize the PHP SDK, create an instance of the Client class. This class facilitates methods to communicate with the Worldline Server API.

The Client constructor requires an instance of a Communicator, which contains all the logic to transform a request object to a HTTP request and a HTTP response to a response object. This class requires an instance of CommunicationConfiguration for holding configuration values, an instance of Authenticator for providing authentication, and an instance of Connection for performing actual HTTP requests. CommunicationConfiguration is a class of which the constructor has the following required parameters:

- $authorizationId: the API key (can be obtained from the Configuration Center)

- $authorizationSecret: the API secret (can be obtained from the Configuration Center)

- $apiEndpoint: the API endpoint URI including scheme. See API endpoints for the possible values

- $integrator: the name of the integrator, e.g. your company name

Only the CommunicationConfiguration is required; if the Authenticator or Connection is not provided a new instance will be created using the given CommunicatorConfiguration. That means you only need to provide an Authenticator or Connection if the defaults aren't sufficient. If that is the case you can use V1HMACAuthenticator for the Authenticator and DefaultConnection for the Connection, or provide your own implementations.

In code:

$communicatorConfiguration =

new CommunicatorConfiguration($apiKeyId, $apiSecret, $apiEndpoint, $integrator);

$communicator = new Communicator($communicatorConfiguration);

$client = new Client($communicator);Client meta information

The PHP SDK supports sending client meta information to the server for business intelligence and fraud prevention purposes. Client meta information can be added using the method setClientMetaInfo on a Client object. The information must be provided in JSON format.

The following code exemplifies the addition of client meta information:

$communicatorConfiguration = new CommunicatorConfiguration(...);

$communicator = new Communicator($communicatorConfiguration);

$client = new Client($communicator);

$client->setClientMetaInfo("consumer specific JSON meta info");Do not use this consumer specific instance for API calls for other consumers.

Payments

As a merchant, your core interaction with Worldline typically starts when your customer clicks the checkout button in your application. The payment process usually has the following steps:

- Payment Product selection

- Setting of available information needed for selected payment product (e.g. amount of the order)

- Collection of missing customer information needed for selected payment product (e.g. creditcard number)

- Submitting the payment request to Worldline

- Handling the response to the payment request (e.g. payment unsuccessful)

Worldline offers three ways of handling this payment process:

- Use a hosted payment through Worldline MyCheckout Responsive Payment Pages.

In this case, you redirect the customer to our Responsive Payment Pages. For you as a merchant, this is the easiest option as Worldline can handle payment product selection and is responsible for the collection of sensitive data like a creditcard number. Through our Configuration Center, you still have a lot of control over the look and feel of the checkout. - Use a Client SDK to build a payment flow for a native app or a JavaScript application.

In this case, your server requests the creation of a client session. This returns a session id with which your client application can communicate with Worldline directly. Your client collects and then encrypts the required customer information. It then sends this encrypted information to your server, where you add all other relevant information and submit a payment request to Worldline. - Use a Server SDK to build a payment flow hosted on your server.

In this case, you can use the Server SDK to obtain the payment products that are applicable to the payment, to obtain the fields that need to be collected from the customer for a selected payment product, and to submit the payment request itself.

In the next couple of paragraphs, we discuss each of these options in more detail.

Use a hosted payment through the MyCheckout hosted payment pages

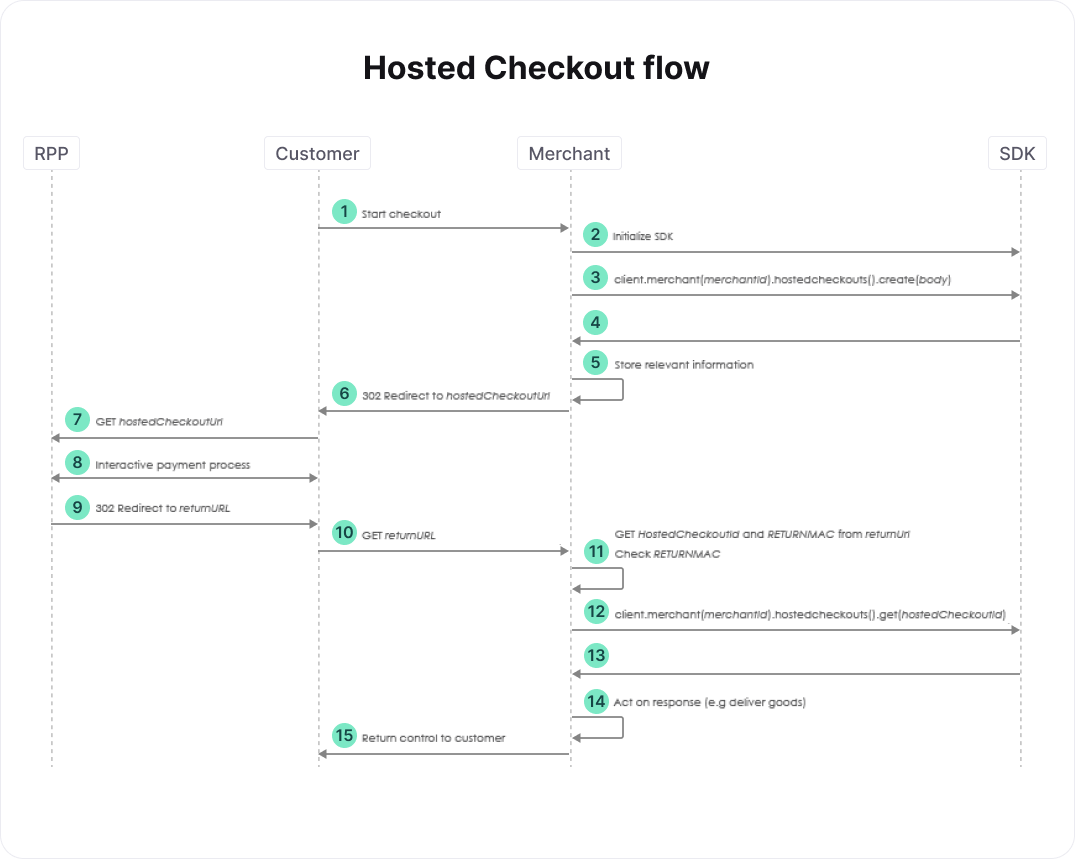

The high-level flow of a hosted payment is described below, followed by a more detailed look at each of the steps.

- At this point, your customer has provided all relevant information regarding the order, e.g. a shopping cart of items and a shipping address.

- See the section on initialization. Create an instance of Client if you hadn't done so yet, and set the metadata that you've collected about the client of the customer.

- Create a CreateHostedCheckoutRequest body and populate at least its Order. See the relevant section of the full API reference for more details. You can specify an optional returnUrl, which is used to redirect your customer back to your website in step 9.

- The create hosted checkout SDK call returns a CreateHostedCheckoutResponse response. Store the hostedCheckoutId and RETURNMAC it contains, as well as any other relevant order information. You will need these when your customer returns from our Responsive Payment Pages, or when the customer fails to return in a reasonable amount of time. Now take response->partialRedirectUrl and prepend "https://yoursubdomain" to it to create hostedCheckoutUrl, where yoursubdomain is a subdomain of the MyCheckout hosted payment pages you requested. You can find your subdomains in the Configuration Center's Payment Page Setup tab, under the Subdomain settings of your merchant. If you are logged in as an adminstrator, you can request a subdomain here as well.

- After completing the interactive payment process in the MyCheckout hosted payment pages, your customer is redirected back to the URL you provided in step 3 as body->hostedCheckoutSpecificInput->returnUrl. The hostedCheckoutId and RETURNMAC you stored in step 5 are added to this URL as query parameters. Specifying a returnUrl is optional, however. As a result, your customer is only redirected back if you've provided a URL in step 3.

- If you cannot identify the customer based on e.g. the HTTP session, you can use the hostedCheckoutId for this purpose. If you do, you must check that the hostedCheckoutId and RETURNMAC from the returnUrl match those that you stored in step 3. Note that the RETURNMAC is used as a shared secret between Worldline and your system that is specific for this hosted checkout.

- Retrieve the results of the customer's interaction with Worldline.

- Check the GetHostedCheckoutResponse response returned in step 13. If response->status equals PAYMENT_CREATED, then the customer attempted a payment, the details of which can be found in response->createdPaymentOutput. Depending on the payment product chosen and the status of the payment you can "deliver the goods" immediately, or set up a regular poll of the created payment to wait for the status. Such a poll is done using the SDK call client->v1()->merchant("merchantId")->payments()->get(paymentId), where paymentId is response->createdPaymentOutput->payment->id. For details on the various payment products and their statuses, see Payment Products.

Additionally, it may be the case that the customer does not return in time (or at all), for example because the browser is closed or because you didn't provide a returnUrl. In this case, you need to retrieve the status of the hosted checkout (step 12) before the hosted checkout times out, which happens after 2 hours, and follow step 14 as well.

Use a Client SDK to build a payment flow for a native app or a JavaScript application

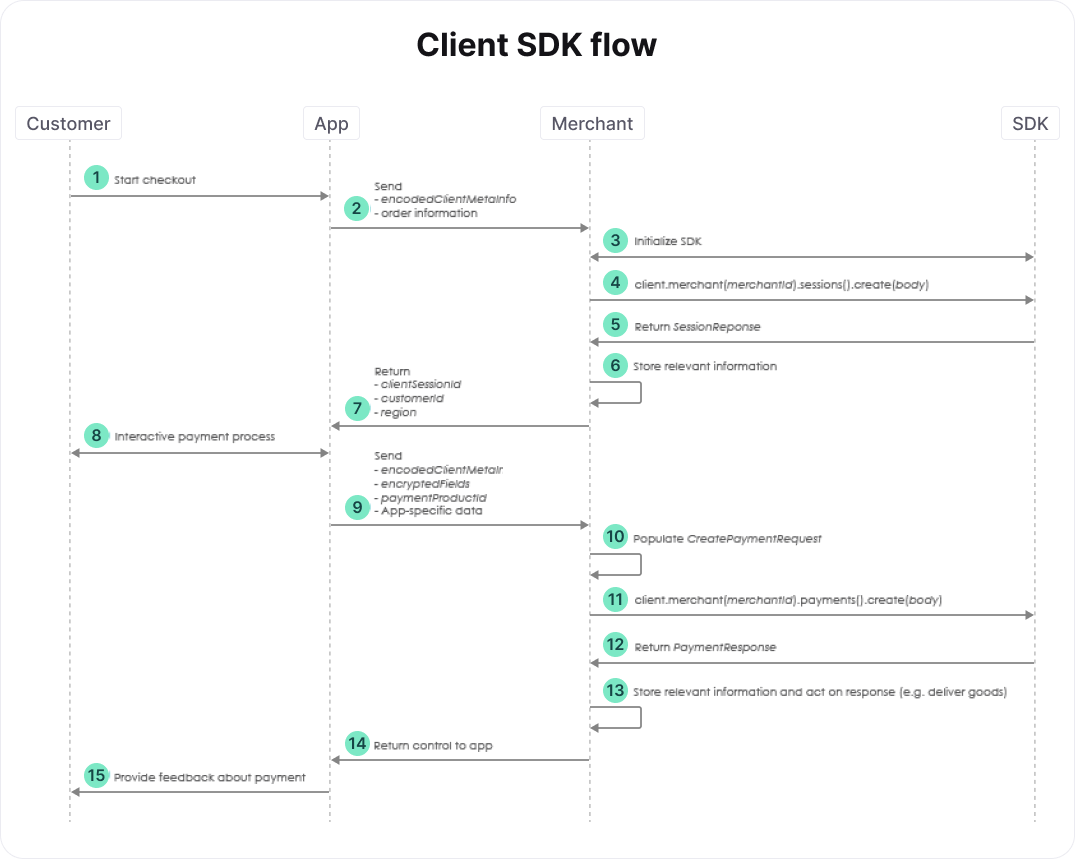

The high-level flow of a payment performed with a native app or a JavaScript application is described below, followed by a more detailed look at each of the steps. First, we discuss the flow for payment products that do not require a redirect to a payment method hosted by a third party. Afterwards, the flow for payment methods that require a redirect is described.

Although this flow uses the Client SDK, we won't go into the details of this SDK here. A detailed description is given in the documentation of the Client SDK.

- At this point, your customer has provided all relevant information regarding the order, e.g. a shopping cart of items and a shipping address.

- The app sends the metadata about the client of the customer and the order information to your server.

- See the section on initialization. Create an instance of Client if you hadn't done so yet, and set the metadata about the client of the customer provided in the previous step.

- Create a SessionRequest body and request a new session. By creating a session, you allow your consumer to communicate with our Client API via your app. See the relevant section of the full API reference for more details. Requesting a new session results in a SessionResponse response, which contains a clientSessionId, customerId, and a region. Store the relevant information to be able to link the order and customer to the payment.

- Send the clientSessionId, customerId, and region to the app. The Client SDK needs this information to interact with the Client API. As mentioned above, the documentation of the Client SDK provides additional details.

- Once the interactive payment process is finished, the app has to send the encodedClientMetaInfo, encryptedFields, and paymentProductId to your server. The encryptedFields contains confidential information about the payment request. Do not store it anywhere. Use the paymentProductId to determine which additional fields you need to provide in the payment request. Some of these fields may come from your app, so you can decide to send additional app-specific data to your server. For payments that require a redirect to a third party, for example, you could send a return URL as app-specific data. Note that for this flow, we assume that we're dealing with a payment that doesn't require a redirect.

- Create a CreatePaymentRequest body. Populate its encryptedCustomerInput with the encryptedFields obtained from the app. Also populate its Order. You may also want to populate the fraudFields and the relevant PaymentMethodSpecificInput. To this end, you can map the paymentProductId obtained from the app to its payment method. For example, for a card payment, you can populate cardPaymentMethodSpecificInput to e.g. set a customerReference or indicate that the payment is the first of a recurring sequence.

- Use the body you just created to perform a create payment request. See the relevant section of the full API reference for more details. The create payment SDK call returns a CreatePaymentResponse response. The status of the payment is accessible via response->payment->status. Depending on the payment product chosen and the status of the payment you can "deliver the goods" immediately, or set up a regular poll of the created payment to wait for the status. Such a poll is done using the SDK call client->v1()->merchant("merchantId")->payments()->get(paymentId), where paymentId is response->payment->id. For details on the various payment products and their statuses, see Payment Products.

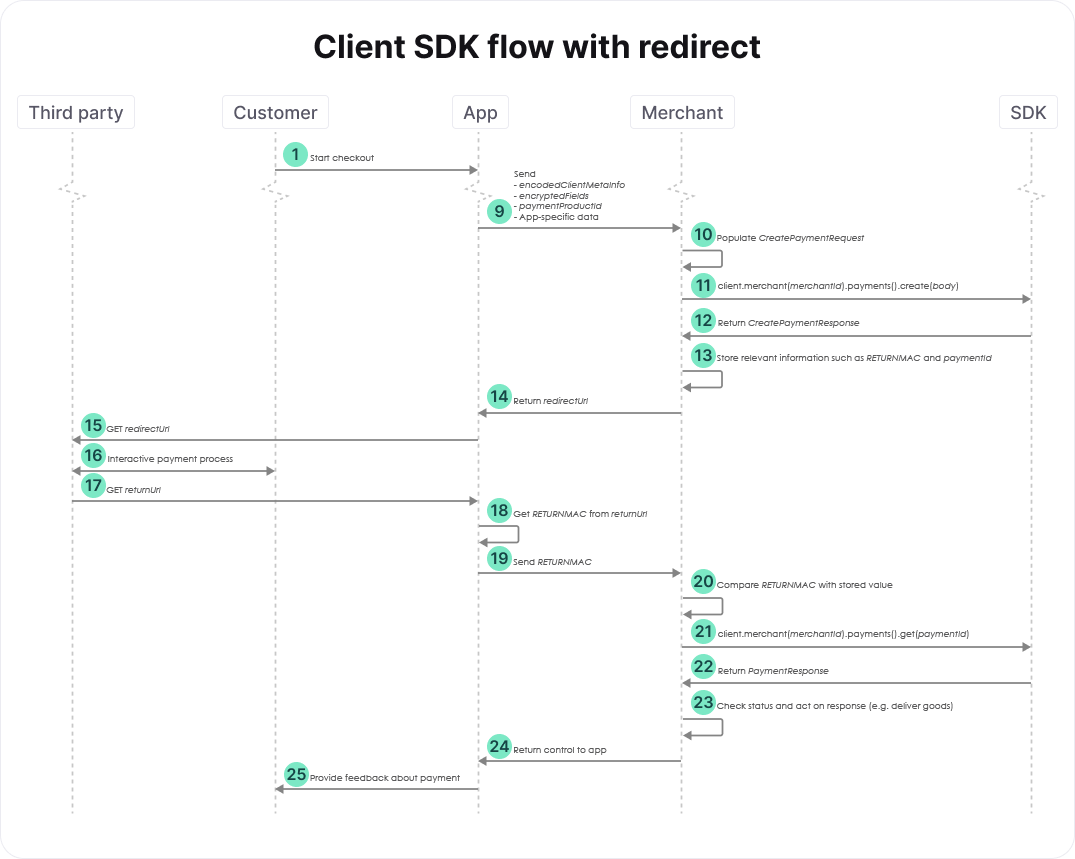

The high-level flow of a payment performed with a native app or a JavaScript application is a little different if a redirect is involved. We only describe the steps that differ from the flow without a redirect.

- The payment process shown in the diagram above involves a redirect of your customer. For this example, we assume that the app decides which returnUrl should be used, which is sent as part of the app-specific data. Your customer is redirected to this URL (i.e., is send back to your app) after completing the payment process. The paymentProductId can be used to determine whether we're dealing with a payment that involves a redirect.

- Create a CreatePaymentRequest body and populate its encryptedCustomerInput and its Order. Additionally, populate its redirectPaymentMethodSpecificInput by providing at least the desired returnUrl. See the relevant section of the full API reference for more details.

- The create payment SDK call returns a CreatePaymentResponse response. For payments involving a redirect, response->merchantAction->redirectData->redirectURL defines the URL to which the customer should be redirected to complete the payment. You need to store the value of response->merchantAction->redirectData->RETURNMAC because it should be compared with the RETURNMAC returned by the app at a later stage. Additionally, you need to store the value of response->payment->id. This paymentId is needed to check the status of the payment after the redirect.

- Send the redirectUrl to your app so that it can redirect the customer to the payment page hosted by the third party.

- After the payment process is completed, your customer is redirected to the returnUrl specified previously. In the flow shown in the figure above, we assume that this URL brings the customer back to the app.

- The app should retrieve the RETURNMAC from the returnUrl and send it to your server.

- You can use the RETURNMAC to identify the customer by comparing it with the one stored previously, and to validate that the customer was redirected to you by our systems.

- Use the paymentId stored previously to check the status of the payment. See the relevant section of the full API reference for more details. The retrieve payment SDK call returns a PaymentResponse response. The status of the payment is accessible via response->payment->status. Use this status to handle the order appropriately, as described above.

Use a Server SDK to build a payment flow hosted on your server

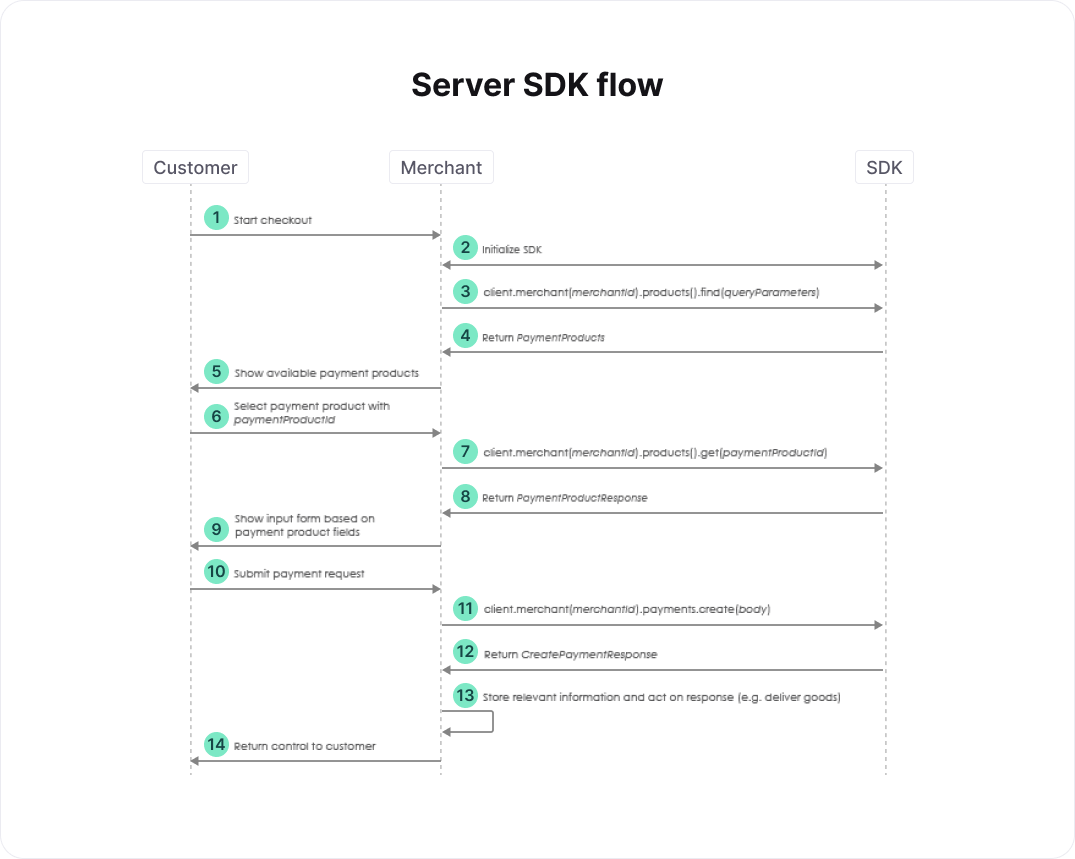

The high-level flow of a payment performed from pages hosted on your server is described below, followed by a more detailed look at each of the steps. First, we describe the flow for payment products that do not require a redirect to a payment method hosted by a third party. Afterwards, the flow for payment methods that require a redirect is described.

- At this point, your customer has provided all relevant information regarding the order, e.g. a shopping cart of items and a shipping address.

- See the section on initialization. Create an instance of Client if you hadn't done so yet, and set the metadata that you've collected about the client of the customer.

- Create FindParams queryParams and request a list of relevant payment products. See the relevant section of the full API reference for more details.

- Show the relevant payment products to the customer such that he or she can select one.

- The customer selects one of available the payment products.

- Once the customer has decided which payment product should be used, you request the fields of this payment product. See the relevant section of the full API reference for more details.

- Based on the information retrieved in the previous step, you render a form that the customer can use to enter all relevant information for the selected payment product.

- The customer submits the form.

- Create a CreatePaymentRequest body, populate its Order and other properties depending on the selected payment product, and submit it. See the relevant section of the full API reference for more details. Do not store the information provided by the customer. The paymentProductId can be used to determine whether this payment involves a redirect to a third party. For this flow, we assume that we're dealing with a payment that doesn't require a redirect.

- The create payment SDK call returns a CreatePaymentResponse response. The status of the payment is accessible via response->payment->status. Depending on the payment product chosen and the status of the payment you can "deliver the goods" immediately, or set up a regular poll of the created payment to wait for the status. Such a poll is done using the SDK call client->v1()->merchant("merchantId")->payments()->get(paymentId), where paymentId is response->payment->id. For details on the various payment products and their statuses, see Payment Products.

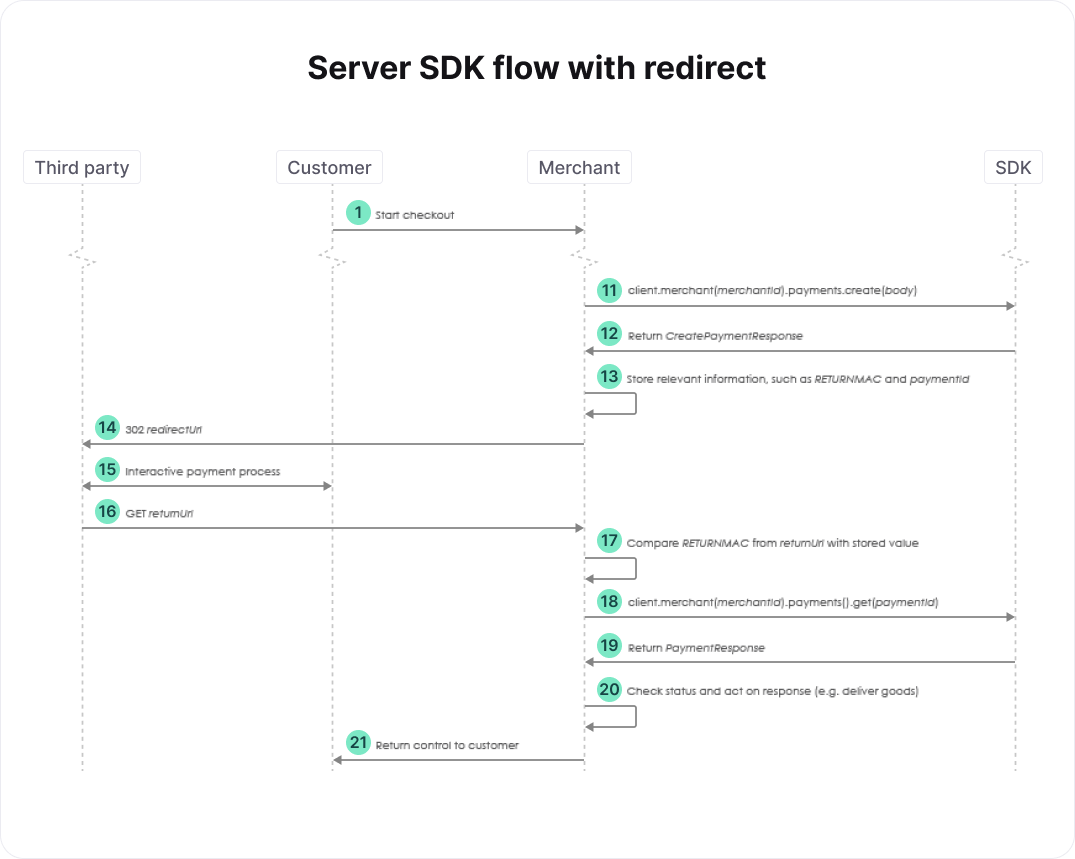

The high-level flow of a payment performed from pages on your server is a little different if a redirect is involved. We only describe the steps that differ from the flow without a redirect.

- We assume that we're dealing with a payment that involves a redirect. As mentioned above, this can be determined using the paymentProductId. Create a CreatePaymentRequest body and populate at least its Order. Additionally, populate its redirectPaymentMethodSpecificInput by providing at least the desired returnUrl. The returnUrl defines the location to which the customer should be redirected after completing the payment process. See the relevant section of the full API reference for more details.

- The create payment SDK call returns a CreatePaymentResponse response. For payments involving a redirect, response->merchantAction->redirectData->redirectURL defines the URL to which the customer should be redirected to complete the payment. You need to store the value of response->merchantAction->redirectData->RETURNMAC because it should be compared with the RETURNMAC returned by the third party at a later stage. Additionally, you need to store the value of response->payment->id. This paymentId is needed to check the status of the payment after the redirect.

- Redirect the customer to the redirectUrl.

- After the payment process is completed, your customer is redirected to the returnUrl specified previously. In the flow shown in the figure above, we assume that this URL brings the customer back to your server.

- Retrieve the RETURNMAC provided by the third party from the returnUrl. You can use the RETURNMAC to identify the customer by comparing it with the one stored previously, and to validate that the customer was redirected to you by our systems.

- Use the paymentId stored previously to check the status of the payment. See the relevant section of the full API reference for more details. The retrieve payment SDK call returns a PaymentResponse response. The status of the payment is accessible via response.payment.status. Use this status to handle the order appropriately, as described above.

File Service support

Uploading files

To upload a file, you need to create an instance of class UploadableFile as part of your request. This class encapsulates the following properties:

- The name of the file (without any path).

- The content of the file. This can be a one of the following:

- A resource that can be read by fread

- A string

- A callable that should take a length argument and return a content chunk of (at most) that size (as a string), or the empty string to indicate there is no more data to read.

If you create any resource, you must make sure this resource is closed after the upload call has finished. The SDK will not close it for you.

- The content type, e.g. application/pdf. Please check the API references for the allowed formats. You can find an incomplete list of content types (also called MIME types) here .

- Optionally, the content length (the size of the file).

Downloading files

To download a file, you need to provide a callable that takes the following arguments:

- A chunk of the content, as a string.

- An associative array with the response headers. These should include at least the Content-Type and Content-Disposition headers. Class ConnectionResponse has utility method getDispositionFilename that you can use to extract the name of the downloaded file.

This callable will be called several times, each time with a new chunk of the content. The same response headers are repeated for each call. This means that if you want to write the chunks to a file based on the file name from the Content-Disposition header, you need to maintain state to only open the destination file for the first chunk.

The SDK provides utility class BodyHandler that can help you with this task. You can create a sub class and override its initialize, doHandleBodyPart and doCleanup methods. The class will make sure the initialize method is called only for the first chunk, the doHandleBodyPart method for each chunk, and the doCleanup method when the BodyHandler is closed. For instance:

class FileBodyHandler extends BodyHandler

{

/** @var resource */

private $file;

protected function initialize($headers)

{

$fileName = ConnectionResponse::getDispositionFilename($headers);

$this->file = fopen($fileName, 'w');

}

protected function doHandleBodyPart($bodyPart)

{

fwrite($this->file, $bodyPart);

}

protected function doCleanup()

{

fclose($this->file);

}

}You can provide an instance of this class as callable using array($bodyHandler, 'handleBodyPart'), where $bodyHandler is the instance of this class.

You must close the body handler yourself after the download call has finished. The SDK will not close it for you.

Idempotent requests

To execute a request as an idempotent request, you can call the same method as for a non-idempotent request, but with an extra CallContext argument with its idempotenceKey property set. This will make sure the SDK will send an X-GCS-Idempotence-Key header with the idempotence key as its value.

If a subsequent request is sent with the same idempotence key, the response will contain an X-GCS-Idempotence-Request-Timestamp header, and the SDK will set the idempotenceRequestTimestamp property of the CallContext argument. If the first request has not finished yet, the RESTful Server API will return a 409 status code. If this occurs, the SDK will throw an IdempotenceException with the original idempotence key and the idempotence request timestamp.

For example:

$callContext = new CallContext();

$callContext->setIdempotenceKey($idempotenceKey);

try {

$createPaymentResponse = $client->v1()->merchant($merchantId)->payments()

->create($createPaymentRequest, $callContext);

$idempotenceRequestTimestamp = $callContext->getIdempotenceRequestTimestamp();

// idempotenceRequestTimestamp contains the value of the

// X-GCS-Idempotence-Request-Timestamp header

// if idempotenceRequestTimestamp is not empty this was not the first request

} catch (IdempotenceException $e) {

// a request with the same idempotenceKey is still in progress, try again after a short pause

// $e->getIdempotenceRequestTimestamp() contains the value of the

// X-GCS-Idempotence-Request-Timestamp header

} catch (ResponseException $e {

$idempotenceRequestTimestamp = $callContext->getIdempotenceRequestTimestamp();

// idempotenceRequestTimestamp contains the value of the

// X-GCS-Idempotence-Request-Timestamp header

// if idempotenceRequestTimestamp is not empty this was not the first request

}Exceptions

Payment exceptions

If a payment attempt is declined by the RESTful Server API, a DeclinedPaymentException is thrown. This exception contains a reference to the payment result which can be inspected to find the reason why the payment attempt was declined. This payment result can also be used to later retrieve the payment attempt again.

For example:

try {

$createPaymentResponse =

$client->v1()->merchant($merchantId)->payments()->create($createPaymentRequest);

} catch (DeclinedPaymentException $e) {

$paymentResult = $e->getPaymentResult();

$paymentId = $paymentResult->payment->id;

$paymentStatus = $paymentResult->payment->status;

$message = 'Payment ' . $paymentId . ' was declined with status ' . $paymentStatus;

//Do something with $message

}Unlike direct payments, indirect payments like iDeal and PayPal usually will not cause a DeclinedPaymentException to be thrown, but instead will result in a CreatePaymentResponse return value. To determine if the payment was successfully finished, declined or cancelled, you would need to retrieve the payment status and examine its contents, especially the status field. It is recommended to use shared code for handling errors.

For example:

try {

$createPaymentResponse =

$client->v1()->merchant($merchantId)->payments()->create($createPaymentRequest);

$paymentId = $createPaymentResponse->payment->id;

} catch (DeclinedPaymentException $e) {

$paymentResult = $e->getPaymentResult();

handlePaymentError($paymentResult->payment);

return;

}

//other code

$payment = $client->v1()->merchant($merchantId)->payments()->get($paymentId);

if (isNotSuccessful($payment)) {

handlePaymentError($payment);

}Payout exceptions

If a payout attempt is declined by the RESTful Server API, a DeclinedPayoutException is thrown. This exception contains a reference to the payout result which can be inspected to find the reason why the payout attempt was declined. This payout result can also be used to later retrieve the payout attempt again.

For example:

try {

$PayoutResponse =

$client->v1()->merchant($merchantId)->payouts()->create($createPayoutRequest);

} catch (DeclinedPayoutException $e) {

$payoutResult = $e->getPayoutResult();

$payoutId = $payoutResult->payout->id;

$payoutStatus = $payoutResult->payout->status;

$message = 'Payout ' . $payoutId . ' was declined with status ' . $payoutStatus;

//Do something with $message

}Refund exceptions

If a refund attempt is declined by the RESTful Server API, a DeclinedRefundException is thrown. This exception contains a reference to the refund result which can be inspected to find the reason why the refund was declined. This refund result can also be used to later retrieve the refund attempt again.

For example:

try {

$RefundResponse =

$client->v1()->merchant($merchantId)->refunds()->create($createRefundRequest);

} catch (DeclinedRefundException $e) {

$refundResult = $e->getRefundResult();

$refundId = $refundResult->refund->id;

$refundStatus = $refundResult->refund->status;

$message = 'Refund ' . $refundId . ' was declined with status ' . $refundStatus;

//Do something with $message

}Other exceptions

Besides from the above exceptions, all calls can throw one of the following runtime exceptions:

- A ValidationException if the request was not correct and couldn't be processed (HTTP status code 400)

- An AuthorizationException if the request was not allowed (HTTP status code 403)

- An IdempotenceException if an idempotent request caused a conflict (HTTP status code 409)

- A ReferenceException if an object was attempted to be referenced that doesn't exist or has been removed, or there was a conflict (HTTP status code 404, 409 or 410)

- A PlatformException if something went wrong on our end, we were unable to process a message from a downstream partner/acquirer, or the service that you're trying to reach is temporary unavailable (HTTP status code 500, 502 or 503)

- An ApiException if the RESTful Server API returned any other error

A payment attempt can now be handled as follows:

try {

$createPaymentResponse =

$client->v1()->merchant($merchantId)->payments()->create($createPaymentRequest);

} catch (DeclinedPaymentException $e) {

$paymentResult = $e->getPaymentResult();

$paymentId = $paymentResult->payment->id;

$paymentStatus = $paymentResult->payment->status;

$message = 'Payment ' . $paymentId . ' was declined with status ' . $paymentStatus;

//Do something with $message

} catch (ValidationException $e) {

$message = 'Input validation error:' . PHP_EOL;

foreach ($e->getErrors() as $error) {

$message .= '- ';

if (!$error->propertyName) {

$message .= $error->propertyName . ': ';

}

$message .= $error->message . '(' . $error->code . ')' . PHP_EOL;

}

//Do something with $message

} catch (AuthorizationException $e) {

$message = 'Authorization error:' . PHP_EOL;

foreach ($e->getErrors() as $error) {

$message .= '- ' . $error->message . '(' . $error->code . ')' . PHP_EOL;

}

//Do something with $message

}

} catch (ReferenceException $e) {

$message = 'Incorrect object reference:' . PHP_EOL;

foreach ($e->getErrors() as $error) {

$message .= '- ' . $error->message . '(' . $error->code . ')' . PHP_EOL;

}

//Do something with $message

} catch (PlatformException $e) {

$message = 'Error occurred at Worldline or a downstream partner/acquirer:' . PHP_EOL;

foreach ($e->getErrors() as $error) {

$message .= '- ' . $error->message . '(' . $error->code . ')' . PHP_EOL;

}

//Do something with $message

} catch (ApiException $e) {

$message = 'Unexpected error:' . PHP_EOL;

foreach ($e->getErrors() as $error) {

$message .= '- ' . $error->message . '(' . $error->code . ')' . PHP_EOL;

}

//Do something with $message

}Exception overview

The following table is a summary that shows when each of these exceptions will be thrown:

| HTTP status code | Meaning | Description | Exception Type |

|---|---|---|---|

| 200 | Successful | Your request was processed correctly | N/A |

| 201 | Created | Your request was processed correctly and a new resource was created. The URI of this created resource is returned in the Location header of the response. |

N/A |

| 204 | No Content | Your request was processed correctly | N/A |

| various; CreatePaymentResult is present in the response | Payment Rejected | Your request was rejected either by us or one of our downstream partners/acquirers. | DeclinedPaymentException |

| various; PayoutResult is present in the response | Payout Rejected | Your request was rejected either by us or one of our downstream partners/acquirers. | DeclinedPayoutException |

| various; RefundResult is present in the response | Refund Rejected | Your request was rejected either by us or one of our downstream partners/acquirers. | DeclinedRefundException |

| 400 | Bad Request | Your request is not correct and can't be processed. Please correct the mistake and try again. | ValidationException |

| 403 | Not Authorized | You're trying to do something that is not allowed or that you're not authorized to do. | AuthorizationException |

| 404 | Not Found | The object you were trying to access could not be found on the server. | ReferenceException |

| 409 | Conflict | Your idempotent request resulted in a conflict. The first request has not finished yet. | IdempotenceException |

| 409 | Conflict | Your request resulted in a conflict. Either you submitted a duplicate request or you're trying to create something with a duplicate key. | ReferenceException |

| 410 | Gone | The object that you are trying to reach has been removed. | ReferenceException |

| 500 | Internal Server Error | Something went wrong on our end. | PlatformException |

| 502 | Bad Gateway | We were unable to process a message from a downstream partner/acquirer. | PlatformException |

| 503 | Service Unavailable | The service that you're trying to reach is temporary unavailable. Please try again later. |

PlatformException |

| other | Unexpected error | An unexpected error has occurred | ApiException |

Logging

The PHP SDK supports logging of requests, responses and exceptions of the API communication.

In order to start using the logging feature, an implementation of the CommunicatorLogger interface should be provided. The SDK provides two example implementations for logging to resources (ResourceLogger) and logging to SplFileObjects (SplFileObjectLogger).

Logging can be enabled by calling the enableLogging method on a Client object, and providing the logger as an argument. The logger can subsequently be disabled by calling the disableLogging method.

When logged messages contain sensitive data, this data is obfuscated.

The following code exemplifies the use of adding a logger:

$communicatorConfiguration = new CommunicatorConfiguration(...);

$communicator = new Communicator($communicatorConfiguration);

$client = new Client($communicator);

$logger = new ResourceLogger(STDOUT);

$client->enableLogging($logger);

//... Do some calls

$client->disableLogging();Advanced use: Connection Pooling

The PHP SDK supports connection pooling by allowing connections to be shared amongst communicators, and by allowing communicators to be shared amongs clients. Pooling is enabled when the same DefaultConnection instance is provided to Communicator instances. The Communicator can in turn be used by different Client instances.

The following example reuses the connections between the different Client instances, since the same DefaultConnection object is used:

$communicatorConfiguration1 = new CommunicatorConfiguration(...);

$communicatorConfiguration2 = new CommunicatorConfiguration(...);

$sharedConnection = new DefaultConnection();

// Use null for the Authenticator so new V1HMACAuthenticator instances will be created

$communicator1 = new Communicator($communicatorConfiguration1, null, $sharedConnection);

$communicator2 = new Communicator($communicatorConfiguration2, null, $sharedConnection);

client1 = new Client($communicator1);

client2 = new Client($communicator2);Advanced use: Customization of the communication

A Client uses a Communicator to communicate with the Worldline RESTful Server API. This Communicator uses a Connection to perform the actual HTTP requests and a ConnectionResponse to hold the HTTP response.

Connection is an interface. The SDK provides a default implementation via classes DefaultConnection. It uses cURL via the standard PHP/cURL bindings to implement the get(), delete(), post() and put() methods.

If needed, the DefaultConnection class can be extended or completely replaced. In order to use this class, initialize the client with an instance of this class:

$communicatorConfiguration =

new CommunicatorConfiguration('ApiKeyId', 'ApiSecret', 'BaseUri', 'Integrator');

$connection = new MyDefaultConnection();

// Use null for the Authenticator so a new V1HMACAuthenticator instance will be created

$communicator = new Communicator($communicatorConfiguration, null, $connection);

$client = new Client($communicator);Advanced use: Proxy

The PHP SDK provides basic HTTP proxy support with authentication. Proxy support is enabled by supplying an optional ProxyConfiguration object to the constructor of the CommunicatorConfiguration class.

To exemplify the use of a proxy, consider the following code snippet:

$proxyConfiguration = new ProxyConfiguration(

'proxyHost',

'proxyPort',

'proxyUserName',

'proxyPassword'

);

$communicatorConfiguration = new CommunicatorConfiguration(

'apiKeyId',

'apiSecret',

'baseUri',

'Integrator',

$proxyConfiguration

);

$communicator = new Communicator($communicatorConfiguration);

$proxyClient = new Client($communicator);Webhooks

The part of the SDK that handles the webhooks support is called the webhooks helper. It transparently handles both validation of signatures against the event bodies sent by the webhooks system (including finding the secret key for key ids), and unmarshalling of these bodies to objects. This allows you to focus on the essentials, and not the additional overhead.

Providing secret keys

Secret keys are provided to the webhooks helper using implementations of interface SecretKeyStore. The PHP SDK provides one implementation: InMemorySecretKeyStore. This will store secret keys in-memory. If more advanced storage is required, e.g. using a database or file system, then you should write your own implementation.

Initialization of the webhooks helper

Using an implementation of SecretKeyStore, create an instance of WebhooksHelper:

$helper = Webhooks::v1()->createHelper($secretKeyStore);Use the webhooks helper

From an entrypoint that you should write yourself, call the unmarshal method of the WebhooksHelper object. It takes the following arguments:

- The body, as a string. This should be the raw body as received from the webhooks system.

- An associative array with the request headers as received from the webhooks system.

If the body is modified, even in the slightest way like replacing line breaks or adding a trailing line break, signature validation will fail.

The array values should be strings representing single header values. If the array values are arrays of header values, signature validation will fail with a PHP type error.

In code:

$event = $helper->unmarshal($body, $requestHeaders);