- Overview

- Countries & currencies

- Integration

- Process flows

- Testing

- Additional information

- Consumer experience

- FAQ

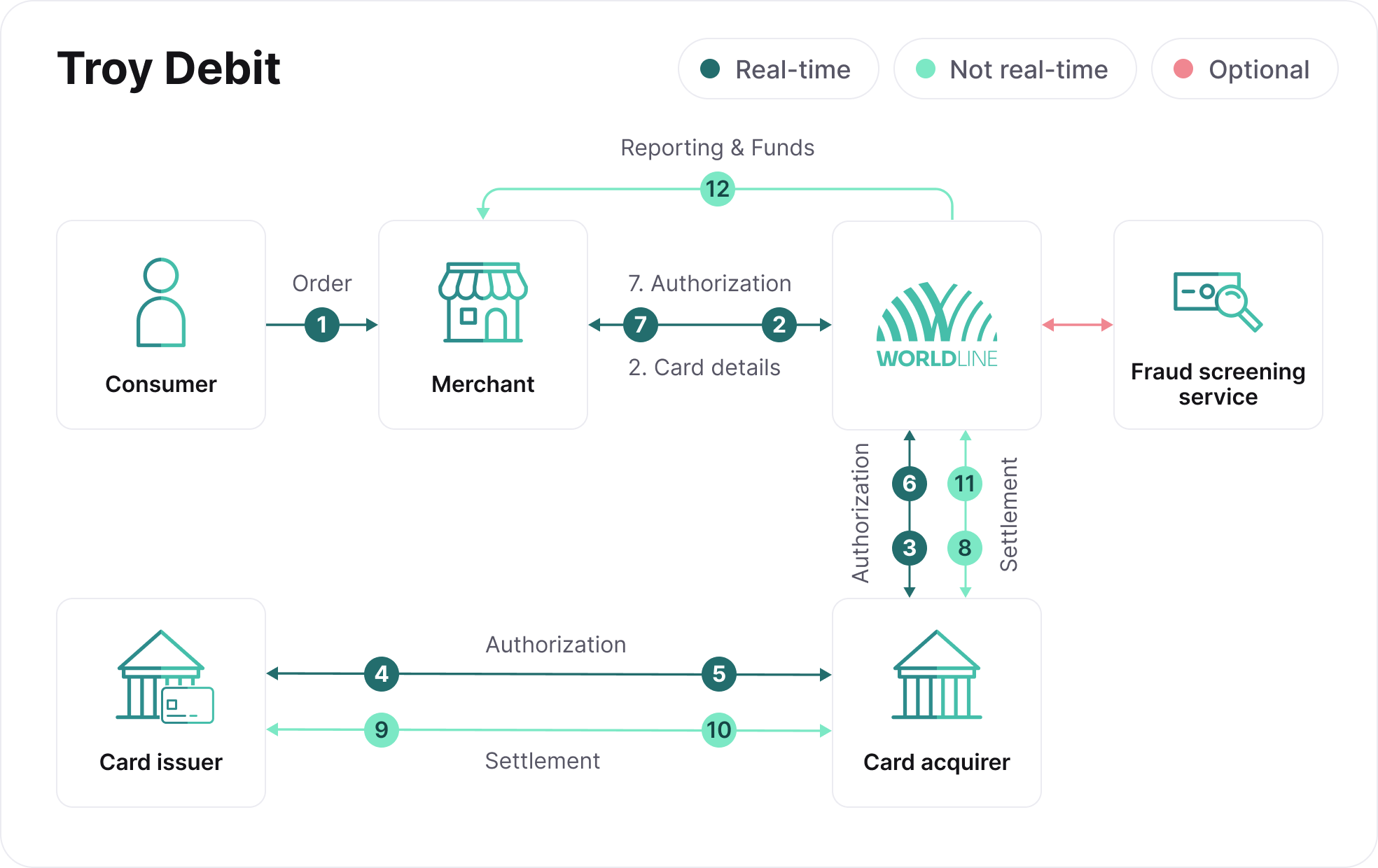

Process flows

To integrate Troy, please refer to our API reference for a more detailed explanation.

- The consumer selects a card payment product and makes a transaction with you.

- Your server sends the authorization request to us containing the card payment details of the consumer and your reference ID.

- We redirect the authorization request to the local acquiring channel.

- The acquirer redirects the authorization request to the issuing bank.

- The bank processes the transaction in real time, returning an authorization or decline response.

- The acquirer sends the authorization result to us.

- We return the request-response result to you. If the request is authorized, you can release the product or service to the consumer.

- We'll also send the settlement file to the acquirer to facilitate the collection of a successfully authorized transaction. It can be done automatically or via a capture request.

- The acquirer sends the settlement request to the card issuing bank, and the consumer's account gets debited accordingly.

The issuing bank transfers the funds to the acquirer. - The acquirer transfers the funds to our bank account, where the confirmation of funds is registered.

- You'll receive the funds and a payment report, including your payment reference. It helps you to update the relevant orders based on the information from the report.

State transition diagrams

The diagrams represent general transaction behavior broken into several stages of the payment flow processed with our platform. Live processing may vary depending on specific circumstances.

Thicker lines mark the general state transitions. The states you see also depend on the setup of your account. More information on the APIs mentioned in the diagram can be found in our API reference.

Account validation

If you perform an account validation using a zero amount in your transaction, the flow diagram is much simpler than the one above. The only complexity here is that you could include an authentication using 3D Secure.

3D Secure - 2 step

In case your account has been configured for 2-step 3D Secure, another completion step needs to be performed. The difference to the generic cards state transition diagram can be seen below.