- Overview

- Countries & currencies

- Integration

- Process flows

- Testing

- Additional information

- Consumer experience

- Reporting

- FAQ

Additional information

Account validation

The issuing banks in Turkey don't support the account validation process with the zero-amount transaction scenario. If you would like to verify the card details provided by a customer, or if you wish to offer a free trial for a product, you need to set the value of the order.amountOfMoney.amount property to 1. This applies for both API calls:

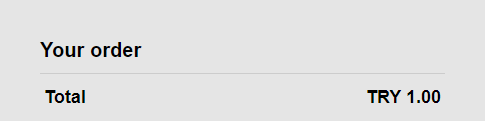

In case you are performing a zero amount verification via MyCheckout hosted payment pages, the customer will see it like this:

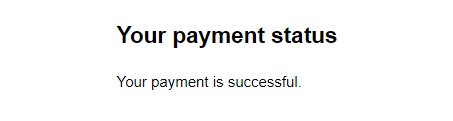

If that transaction goes successfully, the message about it will appear on the page:

Once the payment is successful, you should perform a reversal of authorization to release/return the funds back to the customer's bank account.

Tax liability

Turkey-based companies

Turkish businesses that sell to customers in Turkey are liable to 20% Value-Added Tax (VAT) and must comply with regulations. Registering for this tax and handling all return filings and payments will be up to you.

Non-resident companies

Businesses without a permanent establishment in Turkey providing electronic services to final consumers must register with the tax office and pay the VAT accordingly. It will be up to you or your representative to register for this tax and handle the return filings and payments.

Businesses that sell digital products and services to customers in Turkey might also be liable to a 7.5% Digital Services Tax (DST) on top of VAT. It will be up to you or your representative to register for this tax and handle the tax return filings and payments. The following services are liable for DST:

- all types of advertisement services provided through digital platforms (advertisement control and performance measurement services, data transmission and management services concerning users, and technical services for providing advertisements)

- all types of auditory, visual, or digital content on digital platforms (including computer programs, applications, music, videos, games, in-game applications, etc.) and services provided on digital platforms for listening, watching, playing the content, or downloading the content to the electronic devices

- services related to the provision and operation services of digital platforms where users can interact with each other (including services relating to the sale or facilitation of the sale of goods or services among users)

- intermediary services of digital service providers on digital platforms

Businesses with revenue less than TRY 20 million earned in Turkey or less than EUR 750 million earned globally during the relevant accounting period are free from DST. Also, in case the entity is a member of a consolidated group in terms of financial accounting, the above-mentioned total revenues of the group regarding the services subject to tax shall be taken into consideration in the application of these terms.

Digital service providers should register at tax authorities digital services portal, complete the DST registration form and submit their monthly DST returns to pay by the end of the month. The DST payment can also be made via the portal.

Forbidden industries

Adult and sexual content

- Pornographic products (adult online/live video, image, and video chat tools)

- Child pornography

- Services of an erotic nature (and products that promote them)

- Applications that show signs of the crime/distributing pornography

Illegal substances

- Dissemination of drugs and psychotropic substances or poisons

Pharmaceuticals

- Sale of prescription drugs and glasses

- Merchants and pharmacies that sell bath salts

- Veterinary medicinal products

Copyright and intellectual property

- Selling products/providing services that may encourage or cause copyright infringement

- Products/services that eliminate copyright protections by technical means

- Counterfeit and copyright-infringing commercial products/services

- Products that violate the intellectual and industrial property rights of third parties

Gambling and betting

- Payment for betting debts or gambling winnings, regardless of the location and type of gambling activity

Security and terrorism

- Products and services covered by antiterrorism legislation

Abusive content

- Other products/services that contain insults or abusive language in a way that may damage our company and partner's reputation

Firearms and ammunition

- Firearms and related ammunition

Cryptocurrency

- Bitcoin traders

Financial services

- Payment collectors (acceptance of payments of different companies through the classified virtual POS)

- Business lines that do not want banks to mediate in POS transactions