- Overview

- Countries & currencies

- Integration

- Process flows

- Testing

- Additional information

- Consumer experience

- Reporting

- FAQ

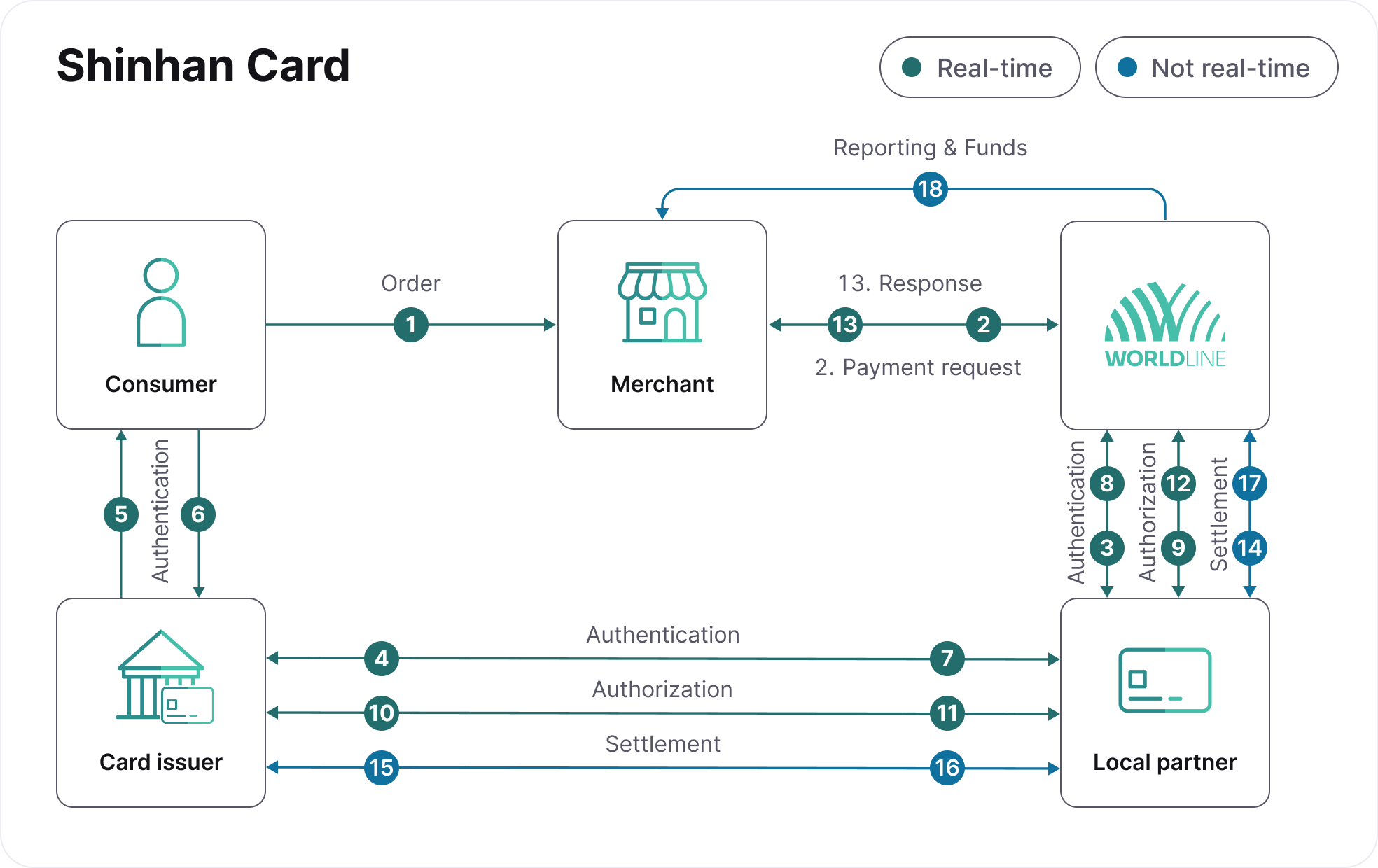

Process flows

Below, you'll find a detailed explanation of the statuses for payments across various flows. In order to integrate Shinhan Card (Authenticated), please refer to our API Reference.

South Korean authenticated cards transaction states

Payment flow

In order to integrate Shinhan Card (Authenticated), please refer to our API Reference.

- The consumer selects a card payment product and makes a transaction with you.

- Your server sends the payment request to us with your reference ID but no consumer card details.

- We redirect the request to the local acquiring channel for authentication.

- The acquiring partner redirects the authentication request to the card issuing bank.

- The issuing bank sends a request to the consumer to authenticate the transaction in real time.

- The consumer authenticates the transaction in real time in the banking app (using Face ID, fingerprint, or PIN).

- The card issuer processes the authentication and returns a success or decline response to the local acquiring partner.

- The local acquiring partner sends the authentication result to us.

- If authentication is successful, we send authorization to the local partner or respond that authentication failed.

- The acquiring partner redirects the authorization request to the card issuing bank.

- The card issuing bank process the transaction in real time, returning an authorization or decline response.

- The local acquiring partner sends the authorization result to us.

- We return the request-response result to you. If the request is authorized, you can release the product/service to the consumer.

- We'll also send the settlement request to the acquirer to facilitate the collection of a successfully authorized transaction. It can be done automatically or via a capture request.

- The acquirer sends the settlement request to the card issuing bank, and the consumer's account gets debited accordingly.

- The card issuing banks transfer the funds to the local acquiring partner.

- The acquirer transfers the funds to our bank account.

- You'll then receive the funds and a payment report that includes your payment reference (you can update the orders based on the information from this report).