- Overview

- Countries & currencies

- Integration

- Process flows

- Testing

- Additional information

- Consumer experience

- Reporting

- FAQ

Consumer experience

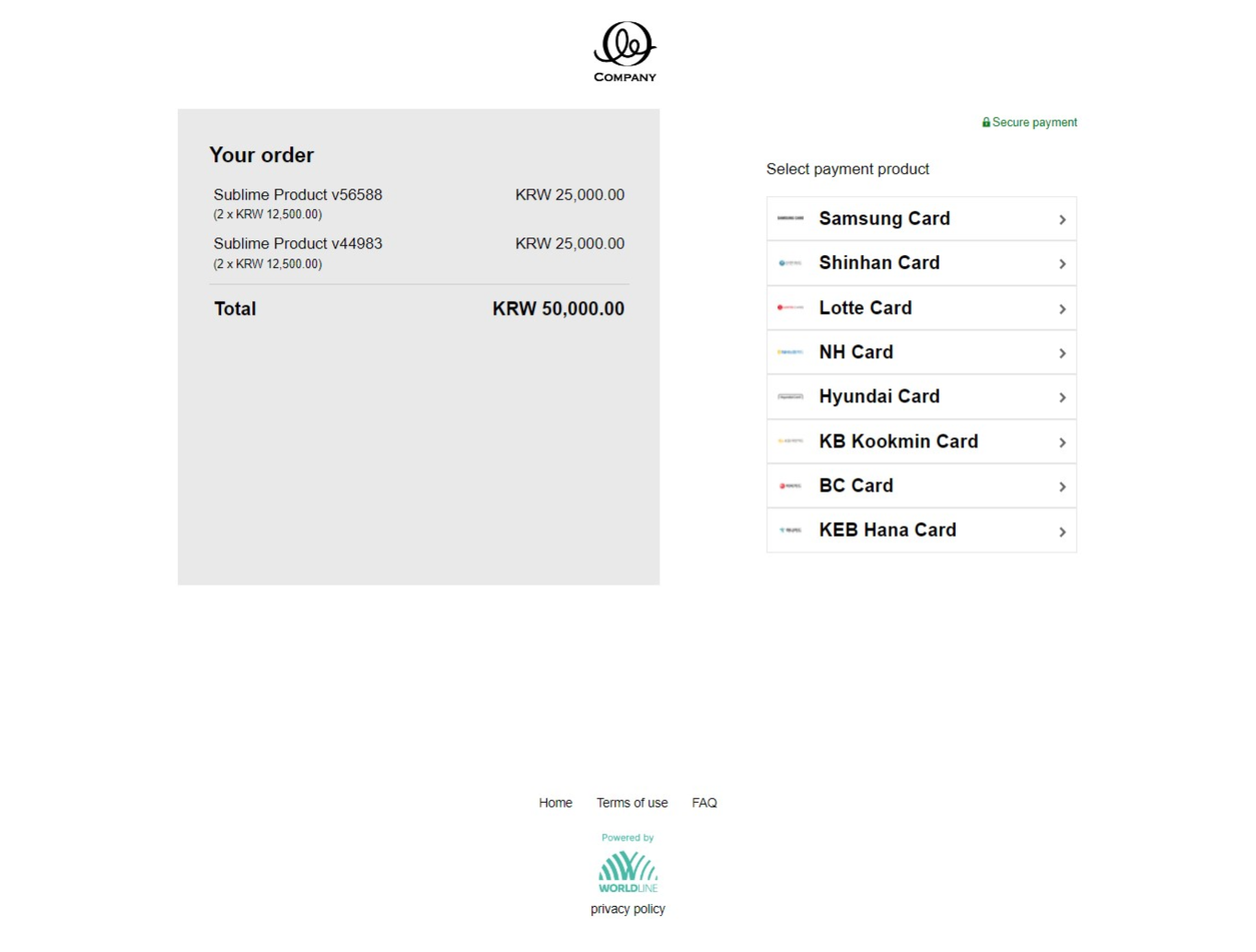

Desktop flow

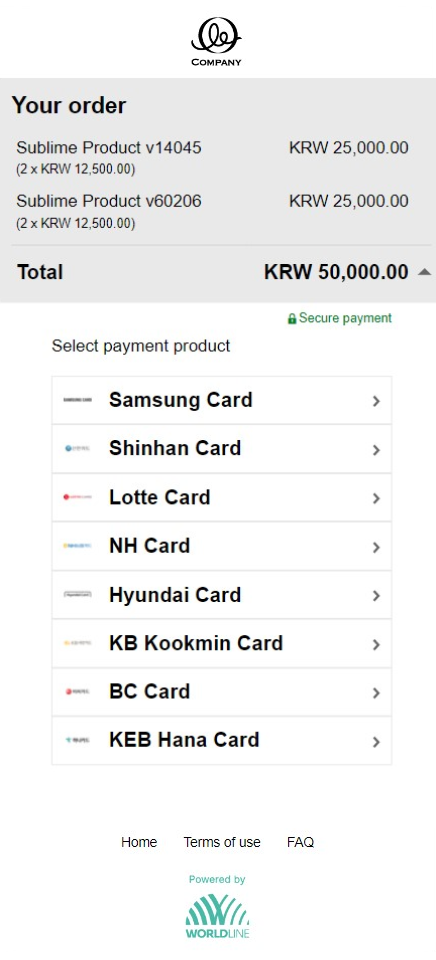

Step 1 – Select the card brand to get redirected to the issuer's page/app.

Step 2 – Select the payment authentication option.

Step 3 – Scan the QR code via the banking app to authenticate yourself. If authentication is successful, we send the authorization request to our local partner in South Korea. Within a few seconds, you get the authorization result.

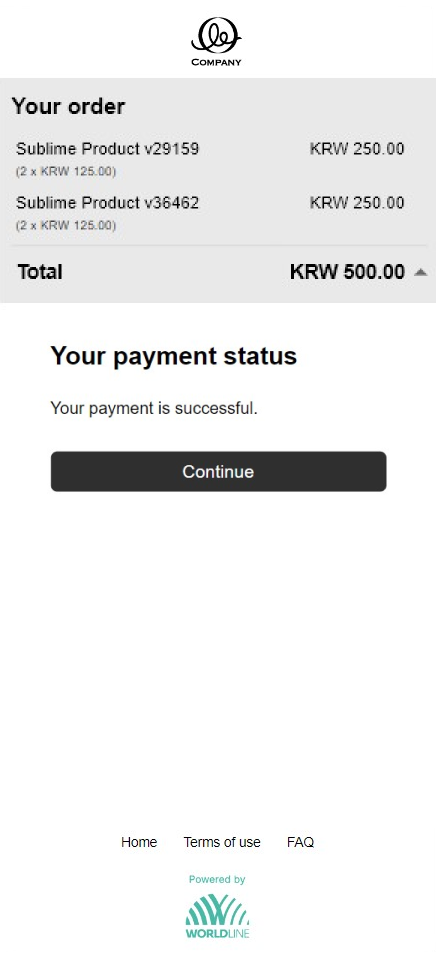

Step 4 – Click "Continue" to proceed and get redirected back to the source website.

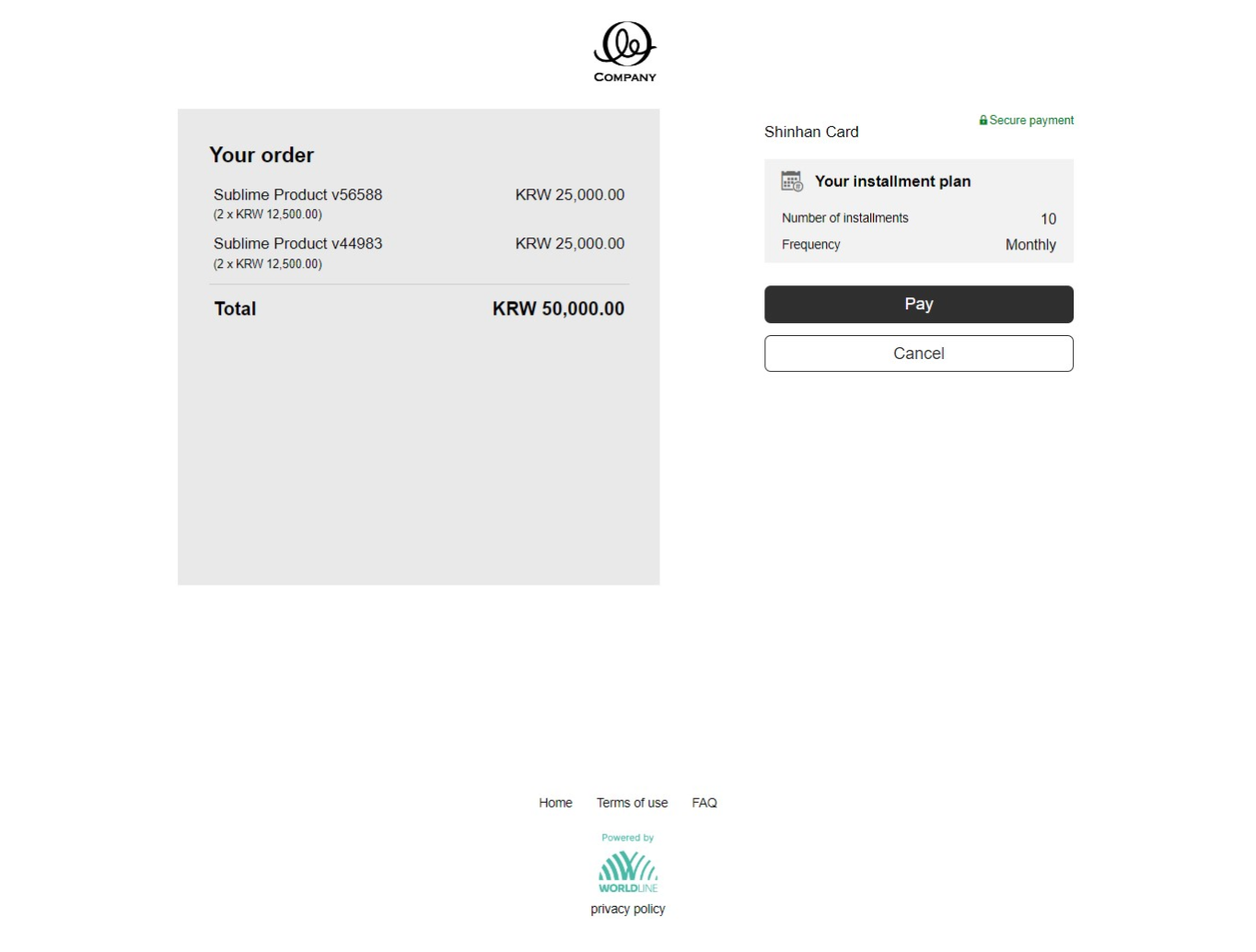

Desktop flow with installments

Step 1 – Select the card brand to proceed further.

Step 2 – Review the submitted installment details and click "Pay".

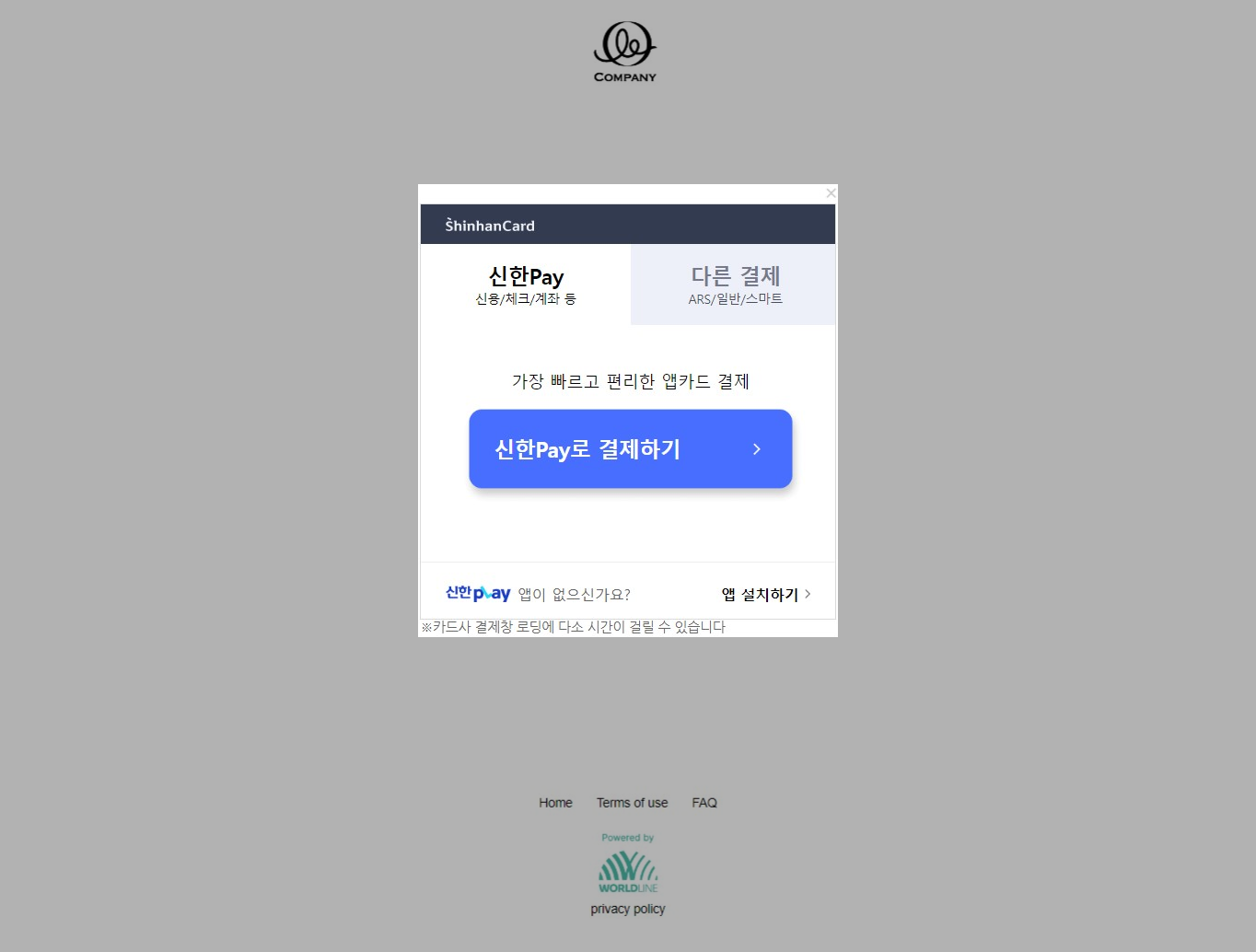

Step 3 – Get redirected to the issuer's page/app and select the authentication option (password/QR code).

Step 4 – Scan the QR code via the banking app to authenticate yourself. If authentication is successful, we send the authorization request to our local partner in South Korea. Within a few seconds, you get the authorization result.

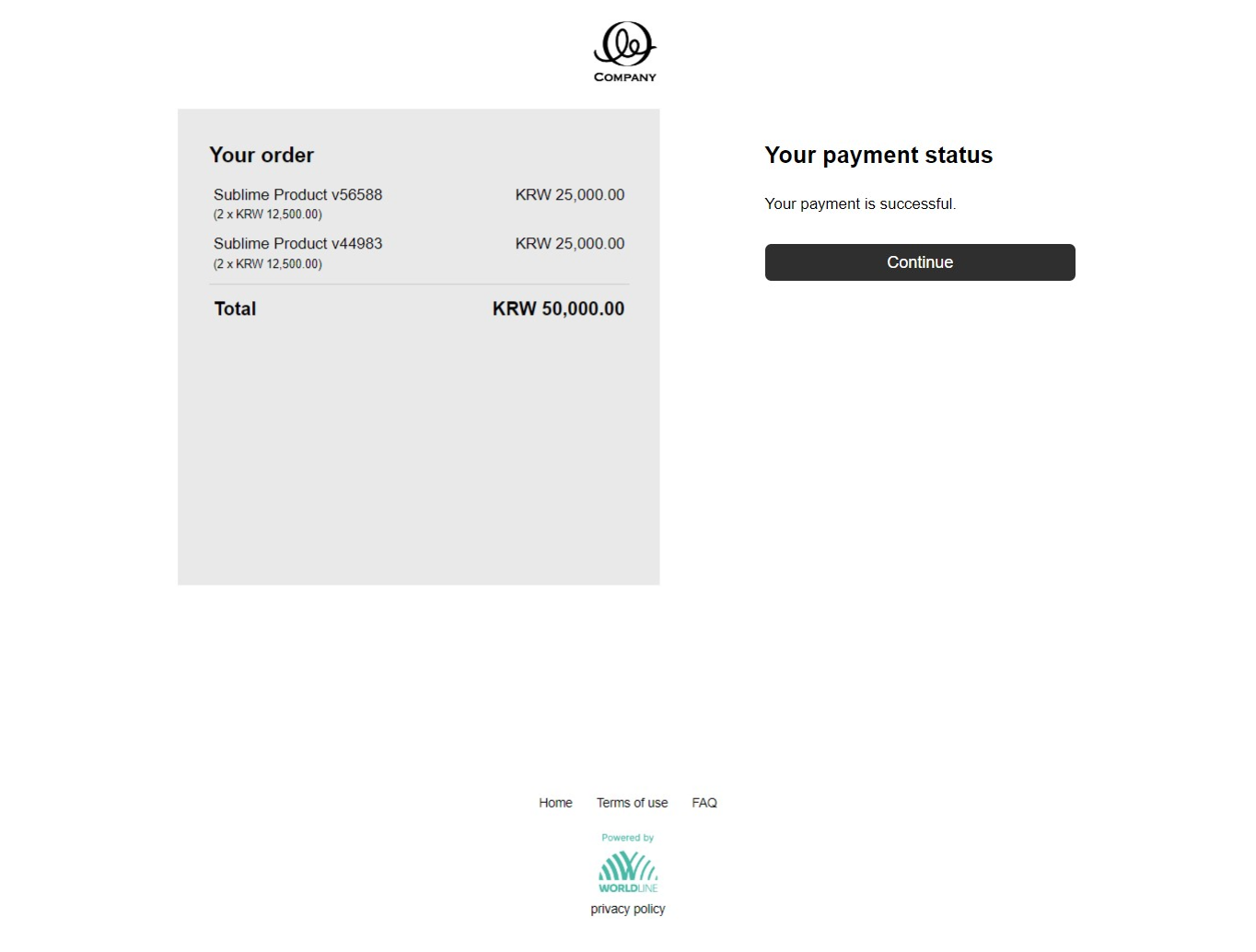

Step 5 – Click "Continue" to proceed and get redirected back to the source website.

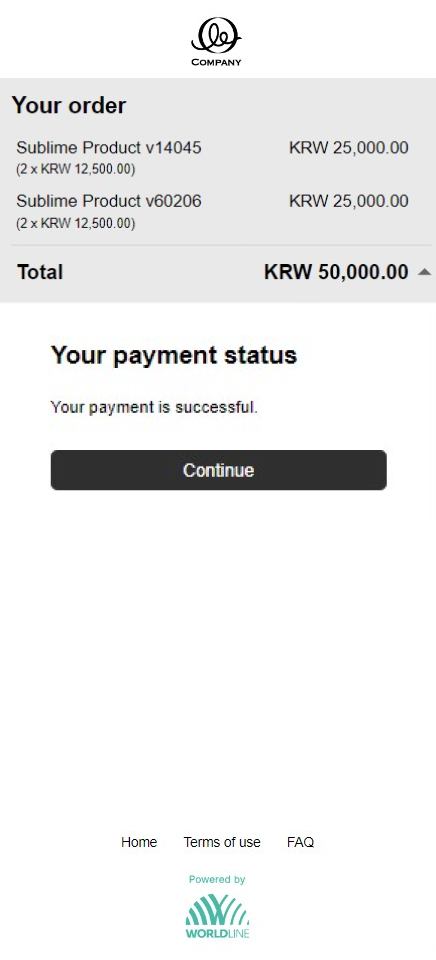

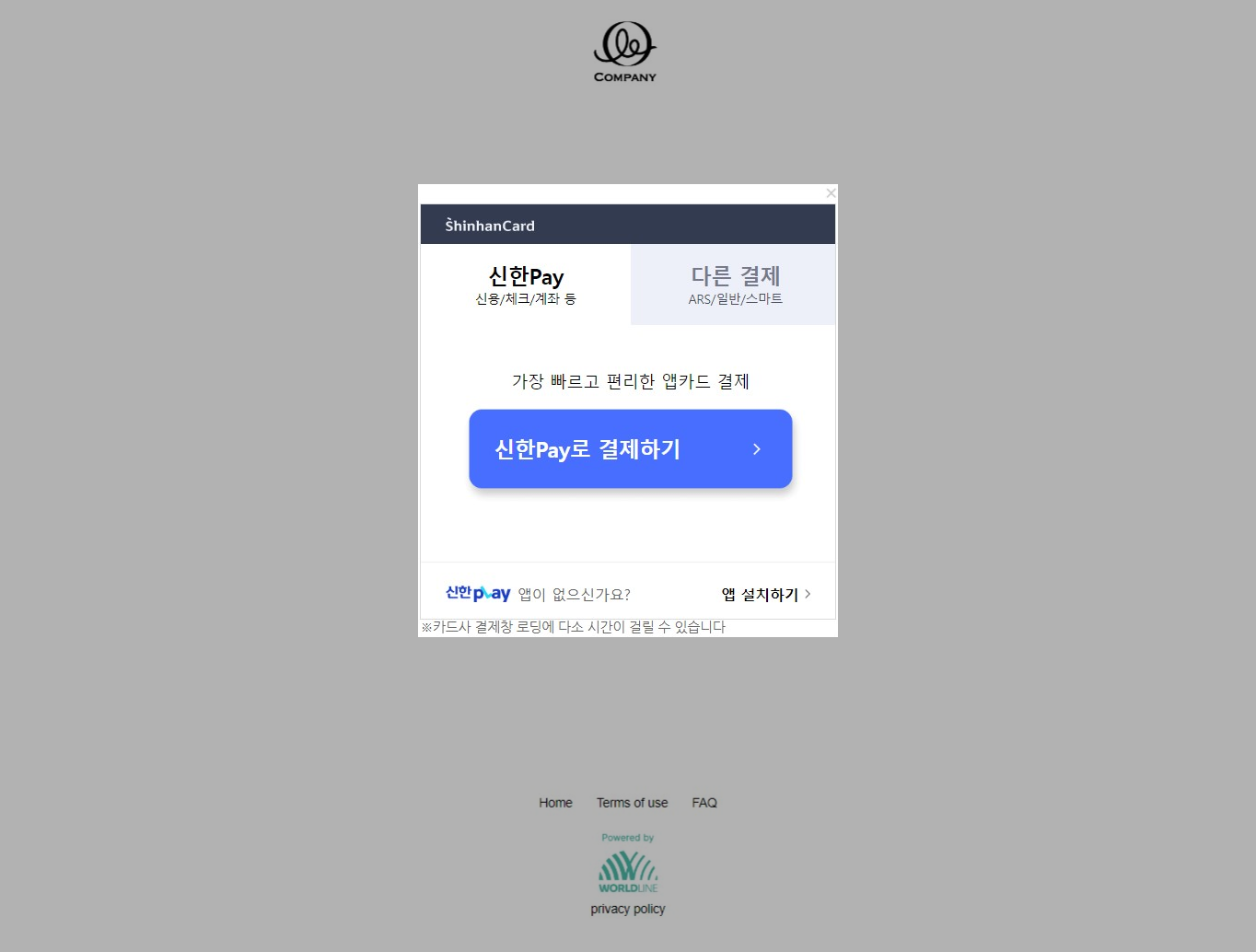

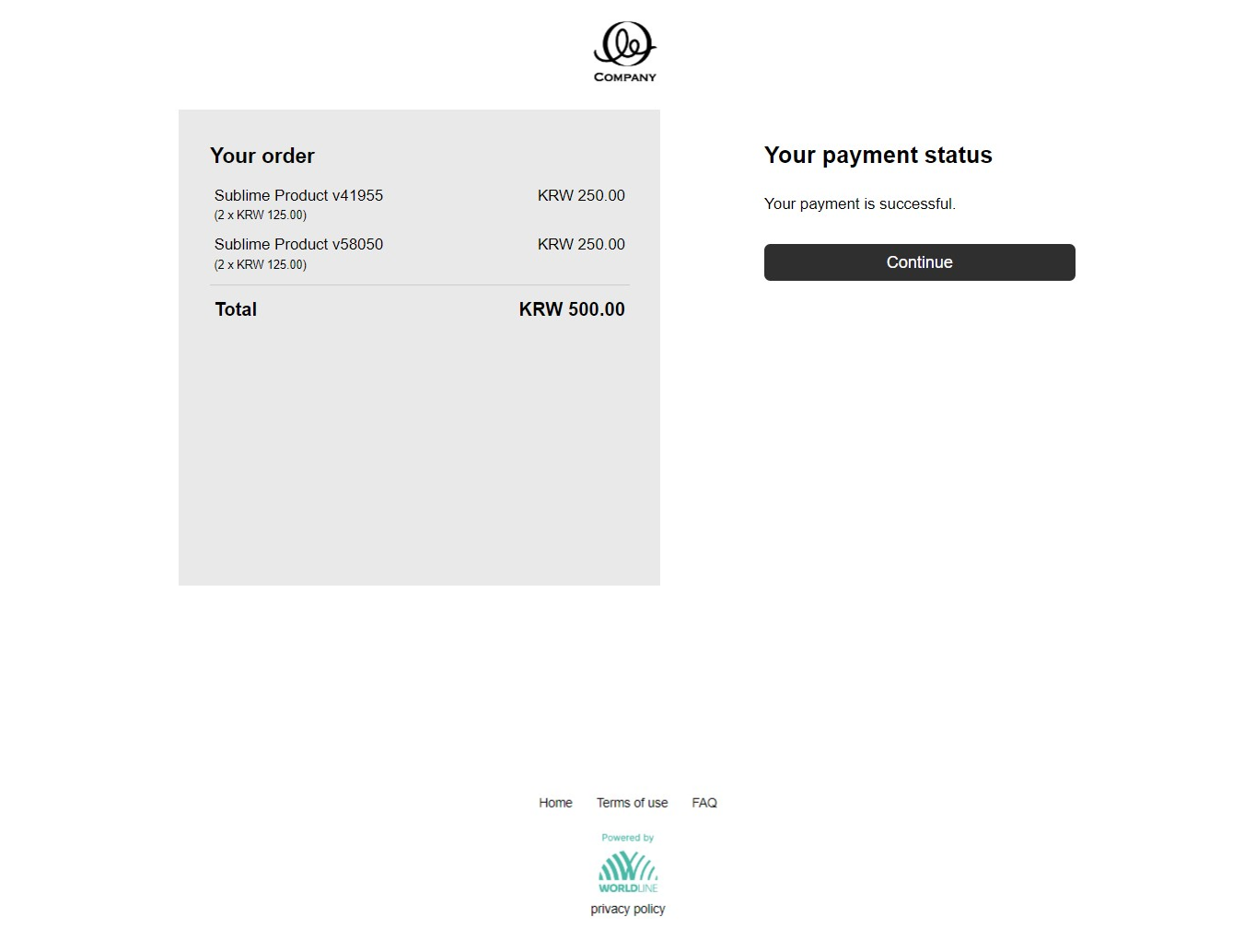

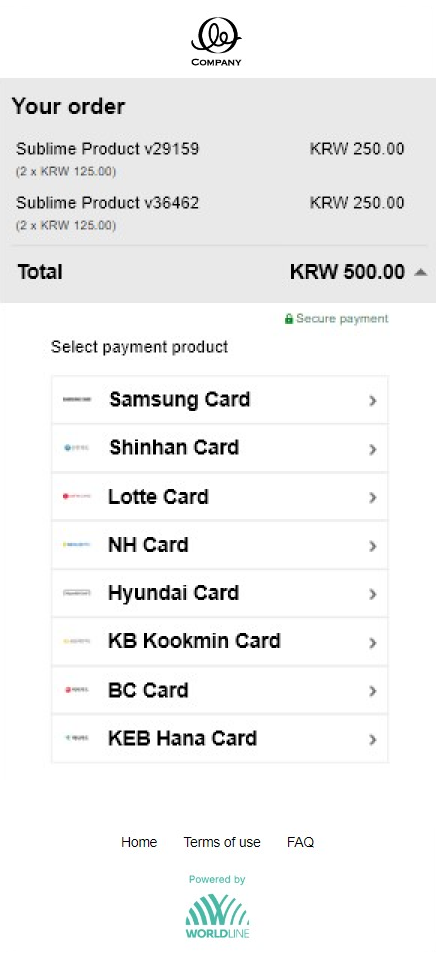

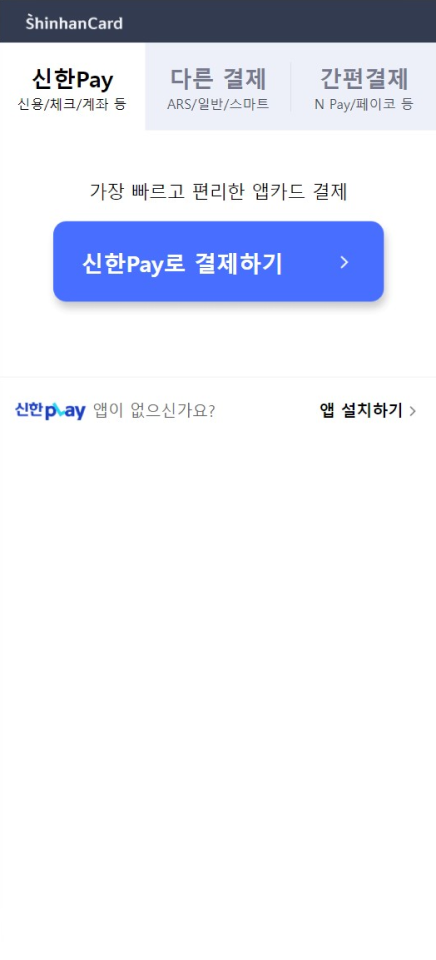

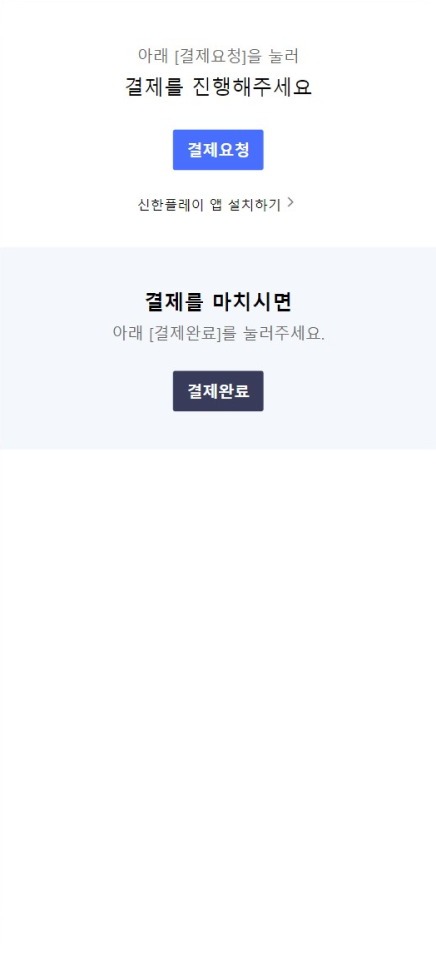

Mobile flow

Step 1 – Select the card brand to proceed further.

Step 2 – Get redirected to the issuer's page/app. Select the authentication option from the list. If authentication is successful, we send the authorization request to our local partner in South Korea. Within a few seconds, you get the authorization result.

Step 3 – Click "Continue" to proceed and get redirected back to the source website.

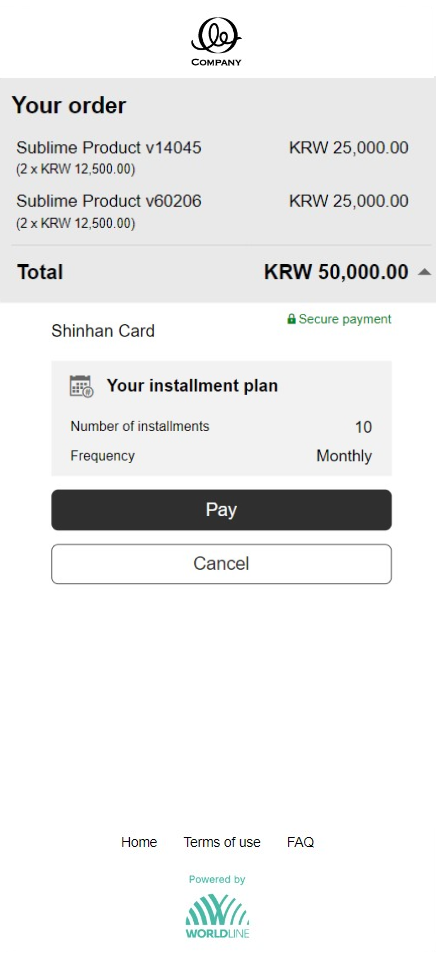

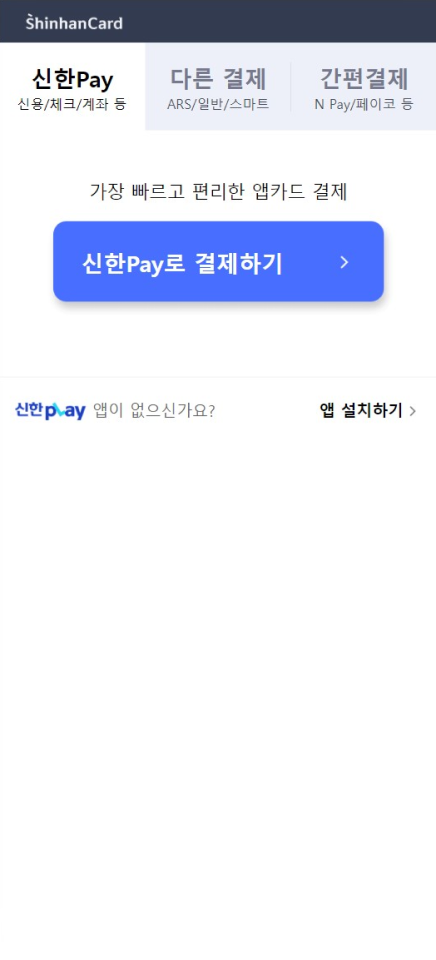

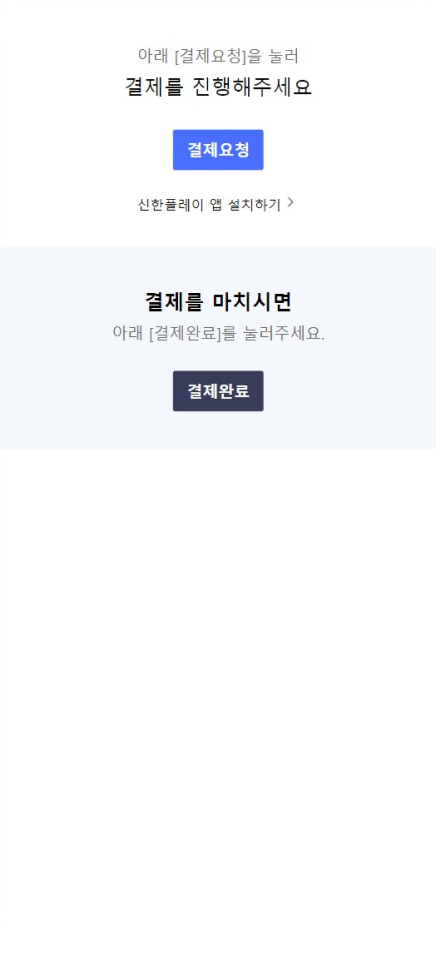

Mobile flow with installments

Step 1 – Select the card brand to proceed further.

Step 2 – Review the submitted installment details and click "Pay".

Step 3 – Get redirected to the issuer's page/app. Select the authentication option from the list. If authentication is successful, we send the authorization request to our local partner in South Korea. Within a few seconds, you get the authorization result.

Step 4 – Click "Continue" to proceed and get redirected back to the source website.